Helping central bankers act with authority

Central banks are among the important financial institutions in the global economy. They play a vital role by implementing robust monetary policy and ensuring smooth operations of the financial markets.

As the dynamics of the world economy change, the role of the central bank is also evolving. New tools and technology are changing the way financial markets operate today. Keeping the requirements of both the central banks and the financial markets in view, LSEG has developed a holistic central bank proposition.

LSEG provides highly secure and bespoke solutions empowering central banks to act with confidence through every step of the financial market ecosystem. Our solutions help central banks improve their operational efficiencies and increase transparency of market participants. With our solutions, central banks can make markets more robust through rigorous reporting and market surveillance tools, remove the risk of manual processes and provide access to larger pools of liquidity.

Solutions

Our central banks solutions

Open market operations / Primary issuance / Auctions

Managing liquidity and maintaining price stability are key responsibilities of a central bank. We help central banks to do both, as well as to effectively conduct open market operations, including serving marginal lending facility and running primary market issuance such as buying or selling currency. We can also automate the entire debt issuance process, from announcing the auctions, to adjudicating bids and publishing the results.

Our single integrated solution leverages on existing market infrastructure to seamlessly connect all market participants.

Secondary market trading

A key function of the central bank is to control the money supply in the economy through its monetary policy, which consists of two parts – currency and credit. Central banks are also tasked with managing foreign exchange reserves and market liquidity. Depending on the specific task at hand, central banks can choose from a variety of trading platforms/liquidity pools.

Tradeweb

Tradeweb is a leading global operator of electronic marketplaces for rates, credit, money market and equities. It provides access to markets, data and analytics, electronic trading, straight-through processing and reporting for more than 40 products, to clients in the institutional, wholesale and retail markets.

Central banks around the world rely on Tradeweb for direct access to deep liquidity, pre-trade price intelligence, flexible protocols and post-trade analysis to enhance their trade execution strategies and drive increased performance. Central banks were early adopters of Tradeweb due to the breadth of available asset classes and full compliance with perpetual audit trail.

Post-trade

Post-trade operations are a critical part of the trade lifecycle within a central bank. LSEG operates venue, neutral, market-wide post-trade services, namely LSEG Deal Tracker and LSEG Trade Notification. These electronic services ensure smooth functioning of middle and back office operations.

Changing regulatory requirements, new communication platforms and rapidly growing data volumes can make compliance daunting. Enterprises are struggling to manage surveillance and investigations across various communication sources — managing trade data further exacerbates the issue. A complex and dynamic regulatory environment requires an integrated, up-to-the-minute approach to compliance. LSEG Compliance Archive provides supervision and surveillance tools, cutting-edge investigative functionality, advanced reporting and immutable storage for central banks.

Regulatory reporting

Central banks play a supervisory role in trading of currency. It needs visibility of the trading practices of financial institutions to police any breach or potential breach of regulations. Central banks are also responsible for ensuring price stability of currency. For this, they needs to monitor markets constantly and be able to intervene intelligently whenever the need arises.

LSEG Market Tracker enables real-time trade reporting. The solution leverages on existing market infrastructure and supports automated reporting of both LSEG and non-LSEG trading venues.

Benchmarks

Central banks and local authorities around the world look to us as the pre-eminent provider of financial benchmark services, whether by calculating a benchmark for an administrator or assuming the responsibility for the benchmark as administrator ourselves.

With a robust regulatory framework and ironclad infrastructure, LSEG is uniquely positioned to provide benchmarks built with integrity, transparency and trust. Where we provide services in connection with benchmark administration, we do so in a manner that is aligned with the International Organization of Securities Commissions (IOSCO) Principles and EU Benchmark Regulation (BMR).

Economics and research

Central banks require high quality data, charting and analytics tools to understand how markets are interacting and to formulate monetary policy. LSEG Workspace with Datastream is the next generation LSEG platform, combining the premier desktop for financial professionals with Datastream’s powerful cross-asset charting and analytical tools. Upgrade from the Datastream Desktop (Advance) to experience enhanced, intuitive and convenient workflow, including auto suggest and shortcuts, and benefit from access to broader content and information, including the world-class Reuters News service, plus integrated collaboration tools.

News

LSEG is the world’s leading financial news provider supported by three key pillars. Reuters sits at the core of our news offering and is combined with global third-party news coverage, made accessible with advanced search and analytics capabilities. Renowned for breaking news and market-moving scoops, Reuters provides timely and trusted national and international news to financial professionals around the world. LSEG combines award-winning Reuters news with thousands of global third-party news sources, providing even greater coverage across markets, regions and business sectors. To ensure our customers get the most from our news offering, artificial intelligence and text analytics make it easy to find actionable news and information of precise relevance.

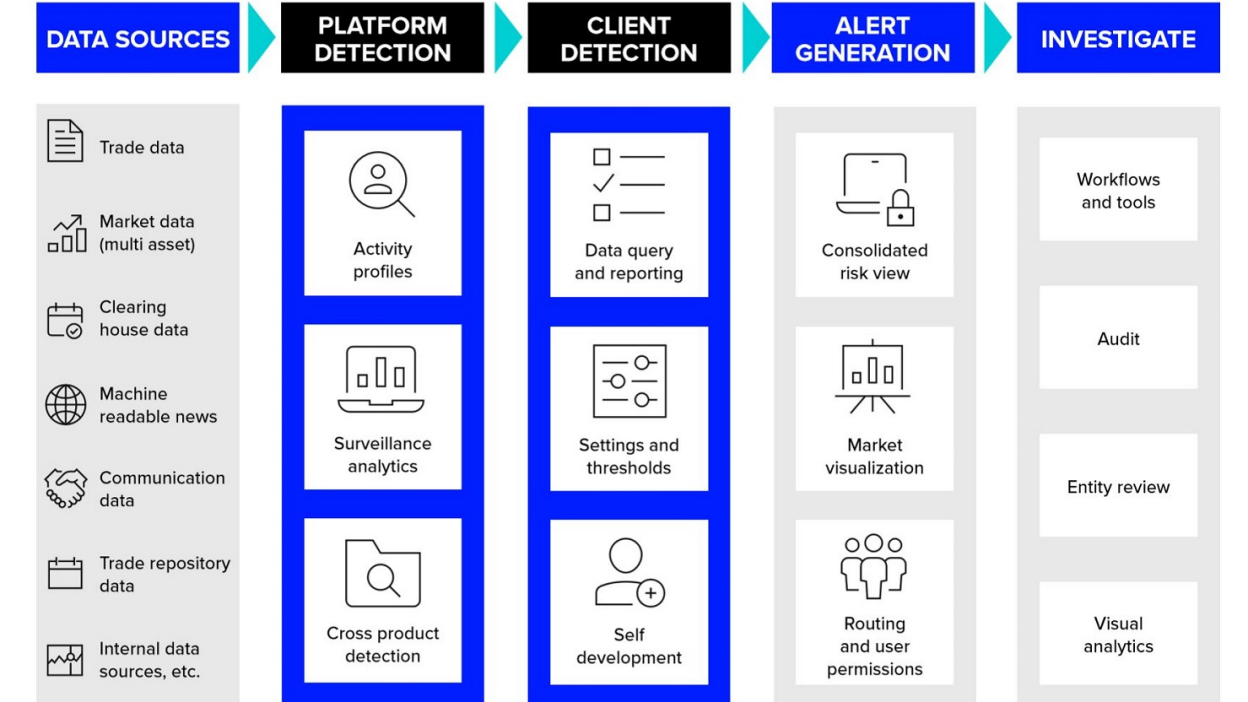

Market surveillance

Financial institutions are expected to strictly adhere to regulations and directives issued by central banks. To monitor adherence to these regulations and ensure orderly financial market operations, central banks undertake effective and robust market surveillance. This includes cross-asset and cross-market trade surveillance, monitoring activities for market manipulation, fraud, behavioural patterning and more. LSEG market surveillance solutions enable central banks to more closely monitor a broad range of products to identify non-compliance issues and record activities.

Why use LSEG market surveillance solutions?

- Multi-asset class and multi-instrument coverage

- Industry-leading detection algorithms

- Customised dashboards and user interfaces

- Case management workflow and oversight that improves investigation effectiveness

- Best in class solution by combining LSEG products along with partners' solutions

Sustainable finance (ESG)

Central banks around the world are increasingly paying attention to the opportunities of responsible investment, for market stability and effective management of government reserves. Using a sustainability lens, central banks can more clearly identify material financial risks and harness the opportunities of more stable, sustainable markets.

Designed to help central banks make sound, sustainable investment decisions, our ESG data covers nearly 70% of global market cap and over 400 metrics. It helps central banks assess the risks – and opportunities – posed by companies’ performance in critical areas such as climate change, executive remuneration and diversity and inclusion. Central banks can carry out their ESG research with complete confidence because every data point is rigorously quality controlled and verified to ensure that it is standardized, comparable and reliable.

Why LSEG?

How we help central banks and market participants in every aspect of the financial market ecosystem

-

300,000+Financial professionals worldwide

-

65+Years of historical economic data

-

150+Global central banking clients

Our data

Our data, your way

Our data offerings mean you can stay ahead - access data easily, assess trends and patterns and understand where the market is heading next.

Request details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576