Monitor and report market participants’ trading activities

Market Tracker provides central banks with real-time details of trades executed on LSEG FX and third-party venues within their jurisdiction; helping them implement their policies and plans

through our advanced data and infrastructure solutions.

Trusted by global central banks, Market Tracker enhances trade reporting and surveillance, ensuring effective monitoring and reporting of market participants' activities.

In today's complex financial landscape, central banks face increased regulatory scrutiny, systematic monitoring demands, and challenges such as currency volatility, market liquidity, inflation, and open market operations. Market Tracker simplifies reporting and tracking by consolidating trade data into a single, real-time stream, empowering central banks to maintain oversight and ensure compliance.

Market Tracker coverage

Market Tracker supports reporting of deals transacted on LSEG’s FX Trading venues in real-time, including Dealing, Advanced Dealing, Matching and FXall.

This solution also supports reporting of deals across single-bank portals, multi-bank portals, ECNs, voice brokers and other non-LSEG third-party trading venues, including white-labelled platforms like Electronic Trading.

Features and Benefits

How LSEG FX Market Tracker can help you

Monitor trade activity in real time across most FX platforms. Market Tracker also captures trading activity for multiple asset classes.

Fully automated service increases accuracy and timeliness of data.

All transactions for asset classes in scope are sent via a single feed and connection.

All transaction data is sent via a secure network.

Transaction data can be stored reliably and used for historical analysis and reporting.

Advanced Dealing and Matching trades feed directly into Market Tracker. Electronic Trading and third-party platforms can easily connect to our system for seamless integration.

Product in action

See Market Tracker in action

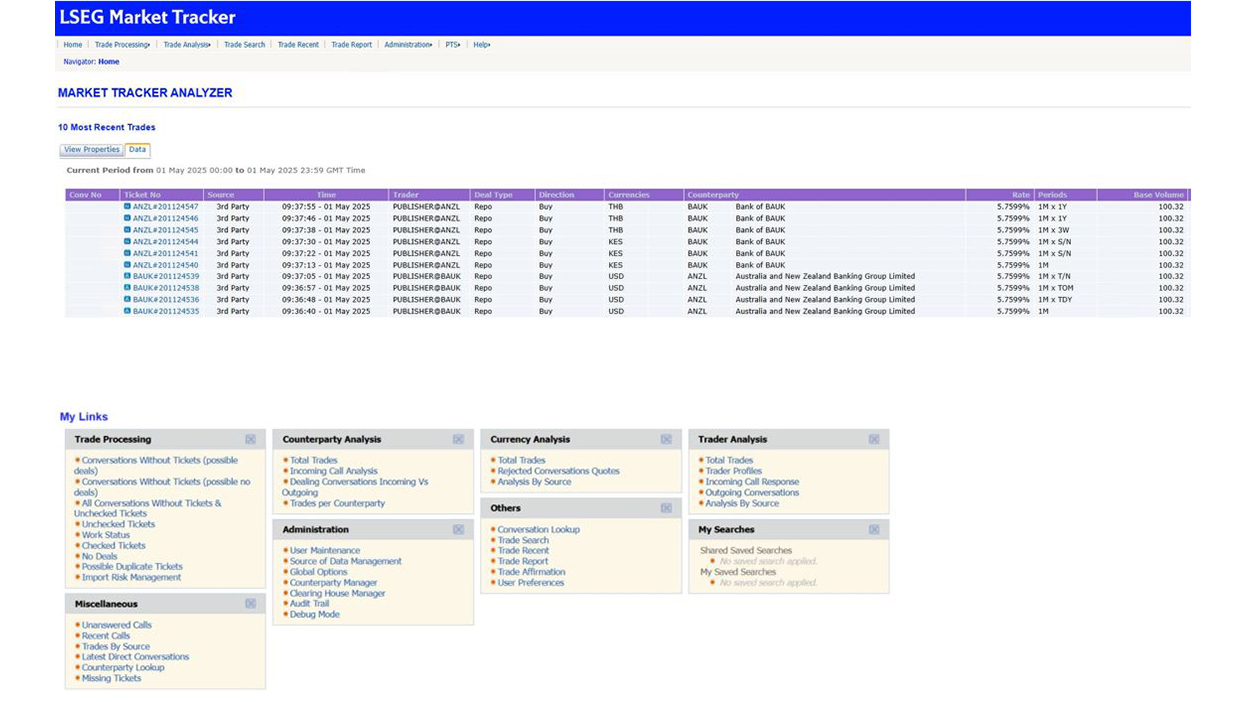

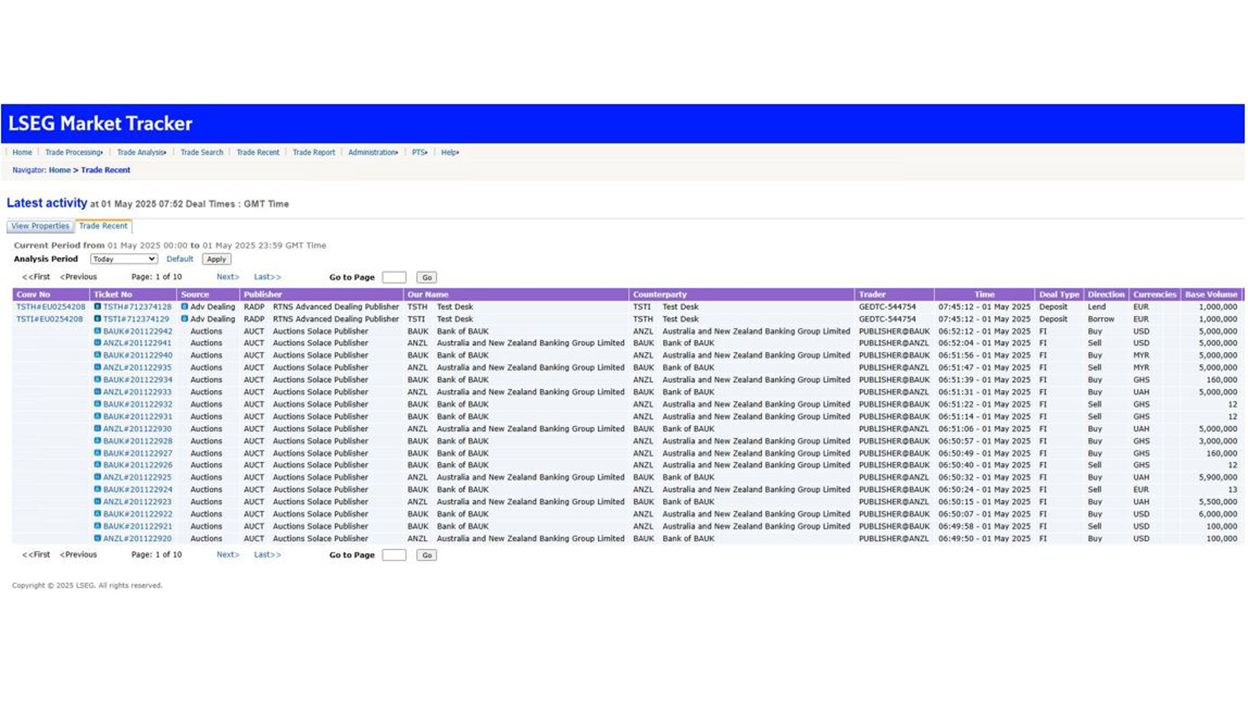

Central Bank view – Market Tracker Analyser interface

View trade data in a structured and consolidated format in the Market Tracker Analyser interface, with search, filter and export capabilities.

Full searching and reporting capabilities

Central banks can see full tick data, attributed to counterparties by deal type, dealer, desk and instrument.

Our solutions

Related products

Request details

Submit your details and one of our experts will be in touch to start the conversation.

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576