Leverage quantitative insights with Yield Book’s unique ESG framework for securitised assets

Solutions

Quantitative climate and ESG analytics across the fixed income universe

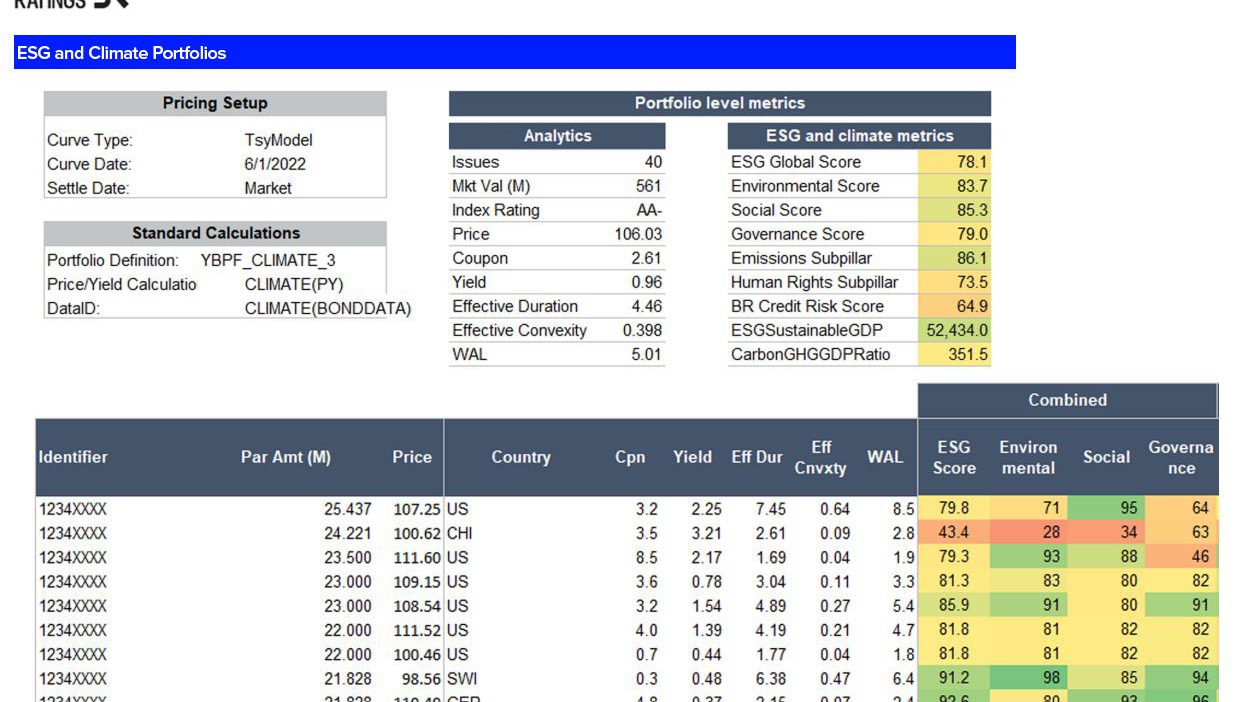

Leveraging our proprietary analytics as the first ESG framework provider for securitised assets alongside LSEG Sovereign Sustainability Solutions, Yield Book brings industry-leading ESG and climate data and analytics providers in one integrated solution.

Optimise portfolios to maximise yield while not compromising ESG credentials, conduct portfolio analytics or investment selection, utilise underlying models to calculate and compare climate impact of fixed income portfolios.

Coverage of nearly $100trn notional outstanding

Yield Book combines access to deep, best-in-asset-class datasets with deep analytics so clients can easily integrate climate and ESG risk analysis into investment processes. Clients can access over 500 ESG metrics across fixed income securities covering nearly $100trn notional outstanding, at both single bond and portfolio level with transparency into underlying drivers.

Source: Yield Book. For illustrative purposes only.

Integrate ESG into fundamental analysis

Assess the impact of ESG on single securities and portfolios, including tracking error and price. Inspect relative performance of indices and rebased equivalents with negative or positive screens, enabling effective integration of ESG credentials as a fundamental part of analysis.

Insights

Find the latest sustainable investment analytics research and insights from our industry-leading experts.

Find out more

Whether you are looking for data, analytics, or indices, discover the sustainable investment solutions available across the London Stock Exchange Group (LSEG).

Request details

Email your local sales team

Help & Support

Already a customer?

Contact us

Sales

Telephone: +1 646 989 2200

Email: sales@yieldbook.com

Support

Telephone: +1 888 333 5618

Email: support@yieldbook.com

Help desk

Telephone: +1 888 333 5617

Email: howto@yieldbook.com