Adnan Halawi

With a growing need for, and adoption of, environmental, social and governance (ESG) screening, integration and investment, we shed light on the areas of overlap and convergence between ESG and Shariah compliance.

- With a clear mandate or preference for Islamic finance, a fund or portfolio manager can use market tools to construct a portfolio of shariah-compliant equities or Islamic bonds – better known as Sukuk – or a mix of both and can track and evaluate against benchmark indices designed for that purpose.

- Using ESG screening tools and platforms, Shariah-sensitive investors have a more comprehensive way of ensuring their funds are invested in assets that meet Islamic principles beyond the classic taboos. This gives an advantage to instruments that meet certain minimum ESG criteria or rating and are Shariah-compliant as they would be best-in-class investments for Shariah-compliant investors.

- The same applies to non-Shariah-compliant sensitive investors and issuers or borrowers who can tackle a wider pool of funds from Islamic capital markets – which are embracing sustainability through increased selling of ESG and green Sukuk, especially in the GCC and Malaysia.

Shariah, also known as Islamic Law, is the overarching law by which an asset class, a financial instrument be it a stock or a bond, a fund or a portfolio, are classified as Shariah-compliant based on a predefined set of rules – such as a ban on interest, and the prohibition of investment in alcohol, pork, weapons, gambling and the likes.

As such, Shariah compliance presents itself as a form of Ethical finance, a faith-based investment, and shares some aspects of negative screening and impact investing. It can also be compared to a rule-based investment strategy. With a clear mandate or preference for Islamic finance, a fund manager or portfolio manager can use market tools to construct a portfolio of Shariah-compliant equities or Islamic bonds – better known as Sukuk – or a mix of both and can track and evaluate against benchmark indices designed for that purpose.

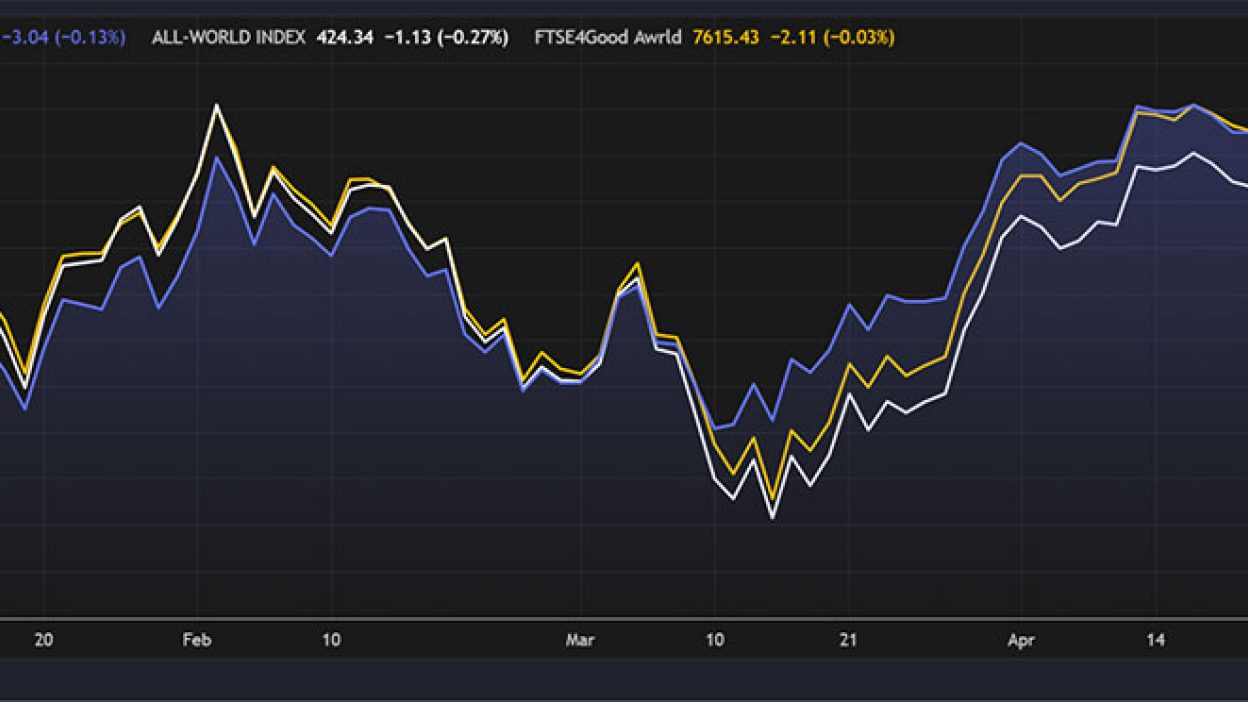

Recently, both World FTSE Islamic/Shariah Equities and ESG Indices have performed better than the conventional FTSE All-World index

Source: Sustainable Islamic Finance App

While screening for ESG is evolving in terms of sophistication of tools, availability of data and level of depth and breadth of coverage, Shariah compliance screening has been in place for some time and, given its less diverse required set of data points, can be considered in a more mature stage of development.

Using ESG Screening tools and platforms, Shariah-sensitive investors have a more comprehensive way of ensuring their funds are invested in assets that meet Islamic principles beyond the classic taboos. For instance, a portfolio of assets which scores high on social factors such as equal pay, naturally aligns with Islam, which calls for justice and equality.

Radzuan Tajuddin, a senior consultant at the World Bank Group Malaysia (Green Taxonomy and Carbon Market Development) suggests that another way to look at this is to view it from a risk standpoint. Not integrating ESG or broader sustainability considerations into Shariah screening impacts Islamic assets – illiquidity, value impairment and stranded assets; and potentially drives the Islamic market as safe haven for unsustainable assets – as the global capital shift intensifies.

Islamic ESG Funds continue to gain momentum globally. According to Blake Goud, CEO of Responsible Finance and Investment Foundation, “It is important for asset managers to evaluate how the Shariah screens change the characteristics of the investment universe, which impacts what the most effective ways to incorporate ESG screening are”. A report by the RFI Foundation suggests that Islamic investment has significant complementary performance benefits with ESG integration.

Refinitiv Islamic Finance: Tools and applications to capitalise on Islamic finance opportunities.

Growth of Islamic ESG Funds

Source: Sustainable Islamic Finance App.

In other words, there is now an advantage for instruments that are winners which meet a certain minimum ESG criteria or rating and are Shariah-compliant as they would be best-in-class investments for Shariah-compliant investors.

The same applies to non-Shariah-compliant sensitive investors and issuers or borrowers who can tackle a wider pool of funds from Islamic capital markets – which are embracing sustainability through increased selling of ESG and green Sukuk, especially in the GCC and Malaysia.

A recent blog by the World Bank noted that “for international investors, ignoring Sukuk comes at a cost, as the product offers them diversifying credits and great credit stories”, let alone if it is an ESG or Green Sukuk.

Historical Issuance of ESG Sukuk

Source: Sukuk Now App

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2023 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.