Leverage leading-edge quantitative analytics and predictive models to optimise your returns and mitigate risks

Introduce new angles to investment strategies, test, validate and benchmark your own quantitative methods with StarMine Analytics and Models. Grounded in sound economic intuition and backed by rigorous analysis, the StarMine suite covers critical areas such as value, momentum, ownership, risk and quality.

We offer flexible access points to cater for your needs: access via desktop, for data visualisations, or via feed for systematic use cases.

-

16Powerful models

-

20+Year proven track record in successful predictive modelling

-

40,000Companies

Features & benefits

What StarMine offers you

With a substantial history of successful predictive modelling – both short and long-term – that carefully leverages overlooked factors to help your alpha generation and risk management processes.

Backed by industry-leading data that sets the market standard in coverage, breadth and history. Our data experts build best-practice models with premium data, saving you time and cost, allowing you to bring solutions to market fast.

Our clear-box design allows you to understand the underlying analytics of our models. Use our final model rankings or the intrinsic components to inform your quantitative processes and test your hypotheses.

We deliver the tools, content and insights you need to reliably predict market movements, identify gaps and pinpoint important trends.

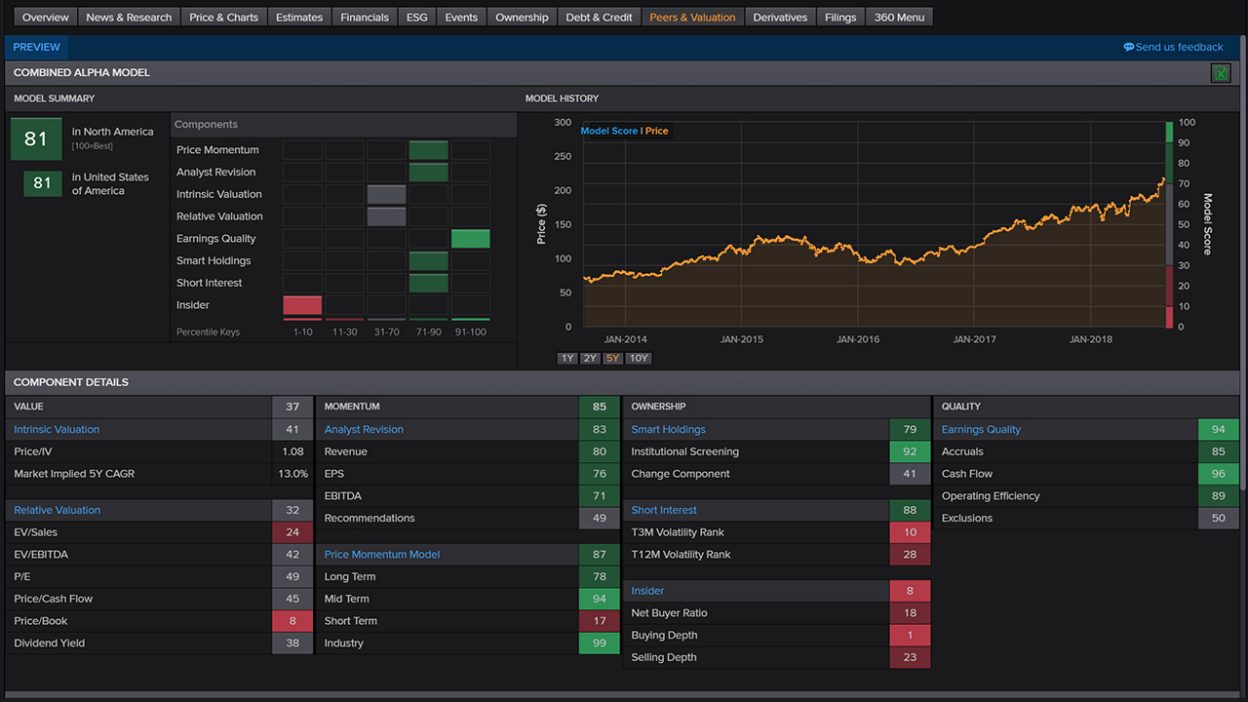

Product in action

StarMine in action: a range of flexible access points

Desktop solution

Advance your data visualisation game

Choose your preferred access point to analytics and models: Workspace desktop, LSEG Quantitative Analytics Database (our quantitative data management solution) or FTP.

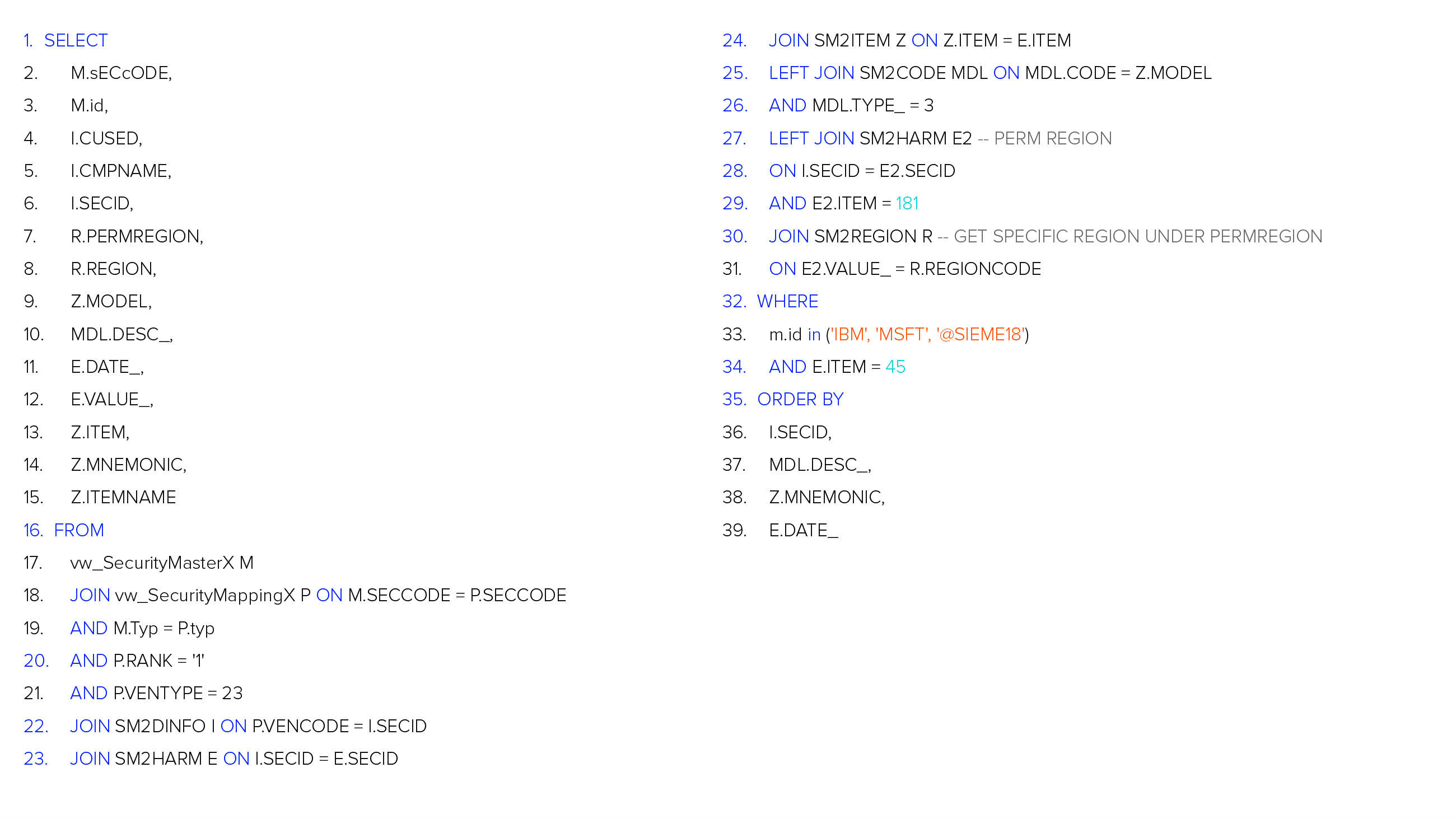

Feed solution

Take your systematic use cases to the next level

Each model’s feed contains time series of the analytics and predictive scores underpinning the model, enabling quants and data scientists to test and incorporate the data into their machine learning and multifactor models.

StarMine Analytics and Models

Analytics and Quantitative models

Analytics

StarMine analytics are best-of-breed proprietary algorithms. These analytics lead to more accurate estimates and serve as powerfully effective inputs to both our own StarMine models and your privately developed models.

Related Analytics:

- SmartEstimates

- SmartEconomics

Classic Factor models

Use it independently or as part of a multi-factor model to adjust for over-optimistic growth forecasts driven by analyst bias, enhancing both forecast accuracy and stock ranking performance. Our models help identify undervalued stocks with rebound potential and overpriced ones likely to revert, while also predicting earnings persistence through our quantitative multi-factor methodology.

Related models:

- Analyst Revisions

- Price Momentum

- Intrinsic Valuation

- Relative Valuation

- Earnings Quality

Smart Money models

Predict stock price changes by leveraging analysis from institutions, short sellers, corporate insiders, and beyond. StarMine Smart Money comprises our Short Interest, Smart Holdings, Smart Holdings Plus, and StarMine Insider Filings models.

Related models:

- Smart Holdings

- Smart Holdings Plus

- Short Interest

- Insider Filings

Combination models

Simplify your stock selection process by using a simple, single score for a company. The Combined Alpha Model score is derived from the optimal combination of available value, momentum, ownership, and quality quantitative models.

Related models:

- Value-Momentum

- Combined Alpha

Credit and Sovereign Risk models

Adopt a multi-faceted approach to predicting credit risk and default probability – StarMine draws on complementary sources of data and analytical methods, so you can quantitatively assess and predict credit risk.

Related models:

- Structural Credit Risk

- SmartRatios Credit Risk

- Text Mining Credit Risk

- Combined Credit Risk

- Sovereign Risk

Mergers & Acquisitions Target model

The StarMine Mergers and Acquisitions Target Model provides a global relative ranking of public companies that are likely to be acquired within the next 12 months. The top decile of the signal identifies companies that are approximately 10 times more likely to be acquired than those in the bottom decile.

MarketPsych Media Sentiment model

The StarMine MarketPsych Media Sentiment stock-ranking model combines MarketPsych’s premier financial media sentiment offering with the rigorous methodology and experience of StarMine research. The product is entirely based on LSEG MarketPsych Analytics, a unique data set scoring media buzz, emotions and topics across over 2,000 news and 800 social media sites, with history reaching back over 20 years. Using well-established relationships between media and stock returns, the model was designed to predict return rankings over the next 30 days.

Request details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576