Optimise your trading in one intuitive place: LSEG Workspace with FXall

Getting an edge in the market relies on the most accurate news and data, powerful pre- and post-trade analytics and precision-driven execution. Put these best-in-class tools into an interoperable ecosystem built around FX trading workflows and you’re not only trading better, but smarter.

Introducing LSEG Workspace with FXall. A truly interoperable and flexible FX trading platform, powered by best-in-class news, executable data and real-time analytics, however you choose to execute your trading strategy.

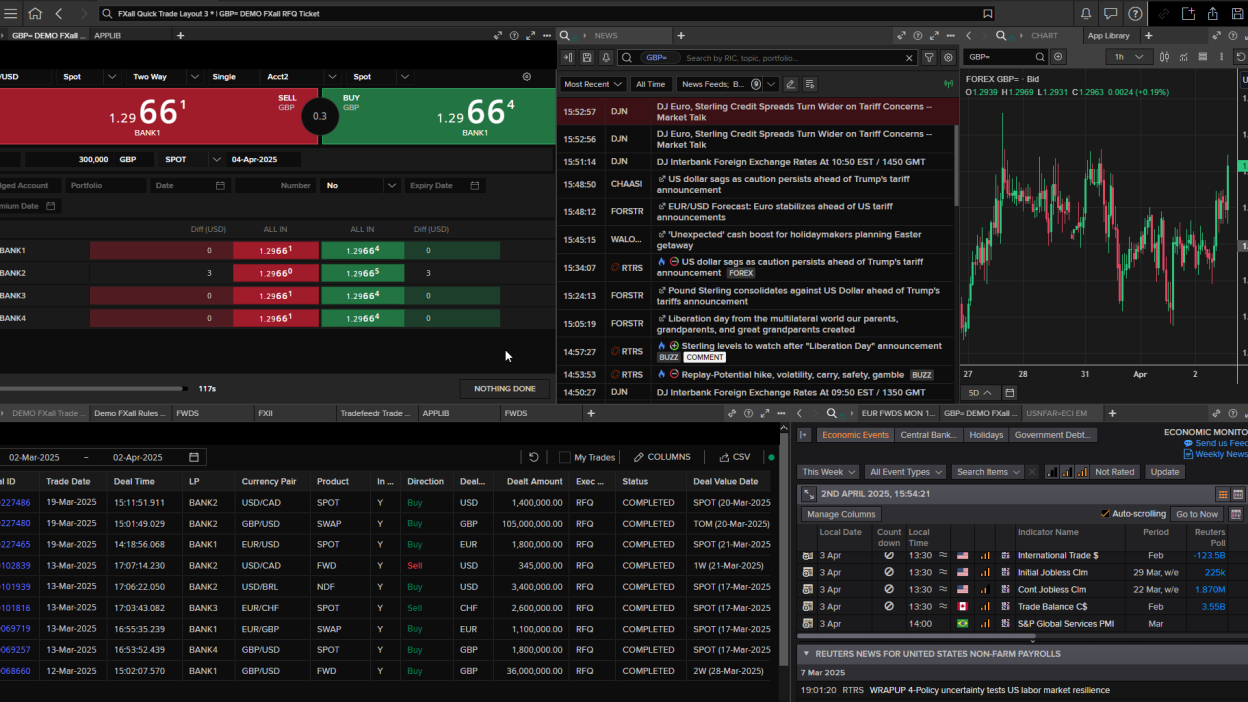

- LSEG Workspace is designed around your FX trading workflow, combining news, data, analytics, a choice of execution methods and evaluation tools in one place.

- FXall is the leading multibank platform for foreign exchange, offering enhanced execution workflows and liquidity from over 200 providers.

Leveraging our open, common core technology, FXall has a brand-new interface within LSEG Workspace, enabling execution of no, low and high-touch trading strategies with ease. Move seamlessly from market monitoring and price discovery to execution and risk management and compliance solutions, sharing context across apps and connecting with your proprietary data and systems.

Useful Links

Your FX ecosystem

From precise insight to flexible execution - seamlessly

Real-time market data and FX insight

- Monitor real-time FX market reference rates sourced from LSEG FX. Click directly into related news and charts. Market data includes turn impact adjusted FX forwards and high frequency spot rates.

- Access specialist FX content such as industry polls, broker research, global economic indicator forecasts and probability-implied central bank rates for future meeting dates. It also gives you access to our team of expert analysts that "follow the sun“, providing a neutral short-term view.

- Use comprehensive broker market composite curves or build your own.

- Gain insight into intraday trading volume and liquidity with the LSEG FX Heatmap, helping you minimise market impact.

Seamless execution

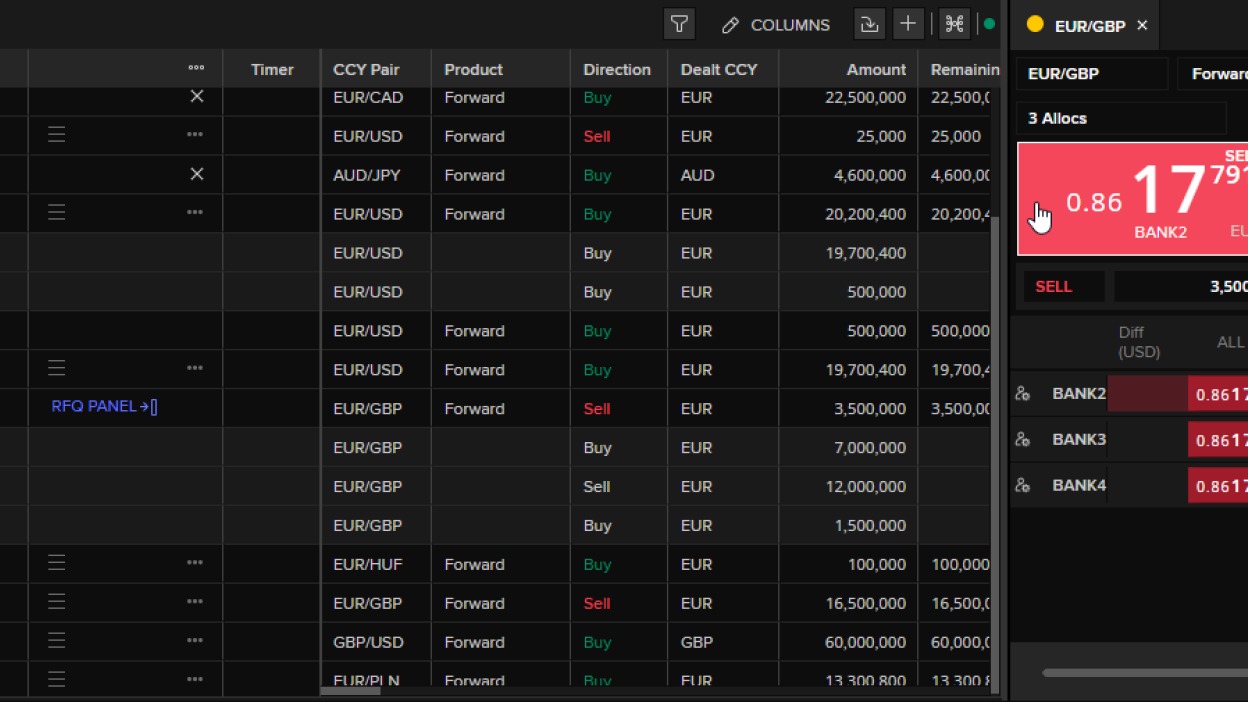

- Trade FX spot, forwards, non-deliverable forwards (NDFs), swaps, non-deliverable swaps (NDS) and precious metals electronically on a single platform with high-speed connectivity to liquidity sources.

- Choose the execution method and FX trading workflow that suits you best. From RFQ to streaming prices, anonymous ECN, and fixing and algorithmic orders, plus full post-trade functionality. FXall provides the choice, agility, efficiency, and confidence you want.

- Click to trade directly from a price. The RFQ ticket auto-populates with parameters passed from the Forwards Calculator application. Then, receive confirmation and route the trade downstream for valuation and risk purposes.

- Stage multiple orders, execute in-line or launch the RFQ ticket. Easily select currency pairs, the type of trade, request type and your liquidity provider.

- Use Send Details to confirm off-platform trades over FXall. You can also import orders via CSV and choose to net or add them to the blotter and net to single order (SSP, swaps or multi-allocation single legs).

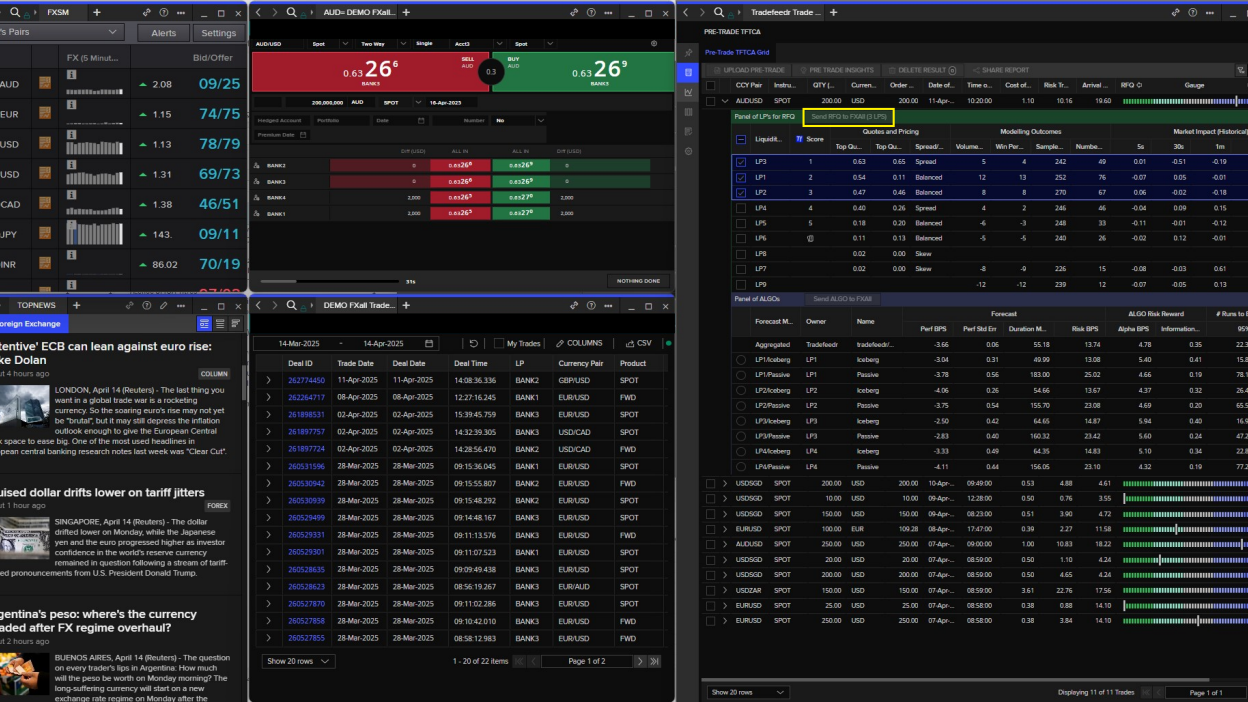

FX Trading Analytics

- Improve your trading outcomes with Tradefeedr's unified data APIs which are part of our FX trading ecosystem. Tradefeedr pre- and post-trade analytics include trading performance benchmarking and collaborative execution quality assessment between liquidity provider and client.

- Easily access multi-asset valuation and risk analytics including mark-to-market, cashflow and P&L analytics for all your FXall trades.

Built around your FX workflow

- Easily cross-reference data and connect with your current Treasury Management System (TMS), Enterprise Resource Planning (ERP) and transaction platforms. Our core, open technology infrastructure gives you easy integration with proprietary systems and data.

- Transform the way you work and collaborate. Our partnership with Microsoft will offer a single integrated experience with Microsoft interfaces such as Microsoft Copilot 365, Excel and Teams for cross-firm collaboration.

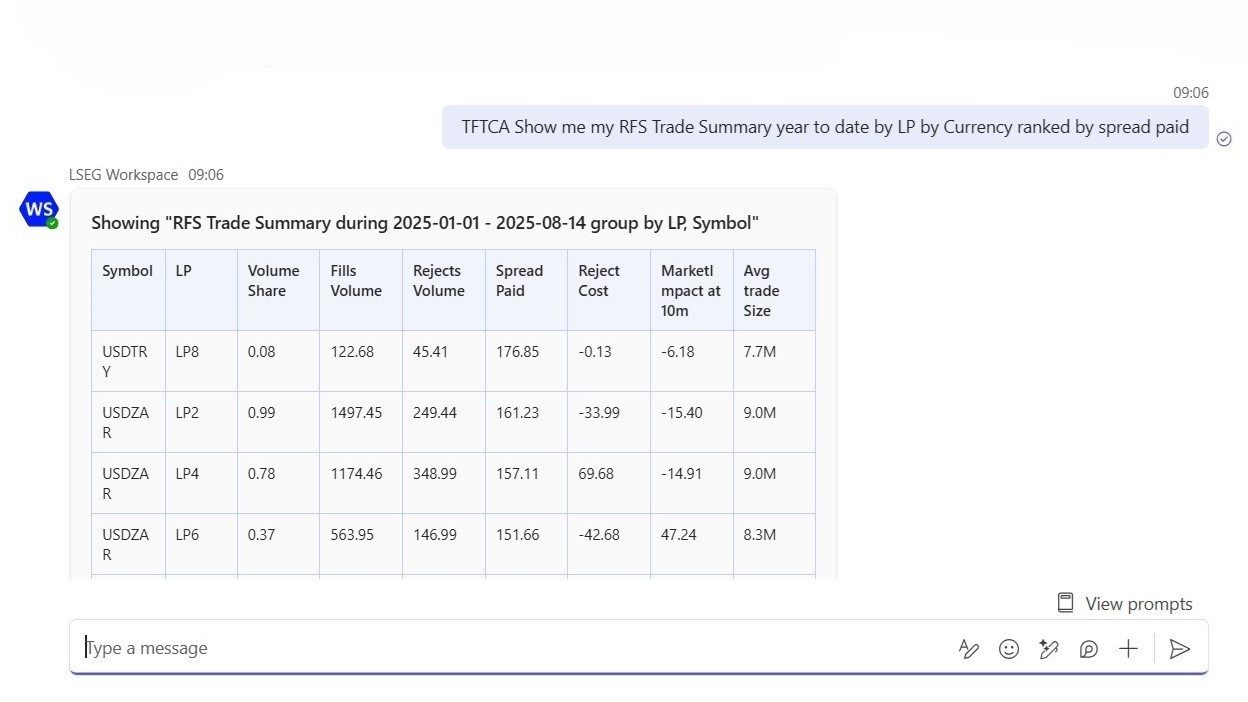

- Engage with LSEG Workspace in Microsoft Teams to request and interact with LSEG data and analytics such as price discovery and performance reports from Tradefeedr.

- Quickly access the latest features and updates. LSEG Workspace is HTML5 native, with a light memory footprint and fast install.

LSEG FX

LSEG FX offers the world’s leading independent source of trusted FX market insight, interbank and dealer-to-client electronic trading venues, workflow management, and post-trade and regulatory support for both sell-side and buy-side market participants.

For more information, please contact your account manager.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2025 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.

Request details

Submit your details and one of our experts will be in touch to start the conversation.