Overview

We offer daily transparency into cleared OTC interest rate swap volumes, across 28 currencies and all major maturities. We publish:

- Daily or weekly aggregated volume of cleared OTC IRS, segmented by key dimensions (currency, product type, client vs dealer) and metrics such as notional volume (in USD, EUR, GBP and traded currency), trade count and DV01 for vanilla swaps

- End of day (EOD) notional outstanding with identical dimensions

Useful Links

Coverage

Varying history on volumes from as far back as 2011 to the present day and updated every trading day. This includes all currencies and interest rate products cleared by SwapClear, such as IRS, OIS, basis swaps or inflation swaps. We cover:

All Registered Trades

- Transactions registered with SwapClear, excluding multilateral and solo compression, netting and blending

- Trade count and notional by currency, product, index and residual tenor bucket

- Available pre and post clearing

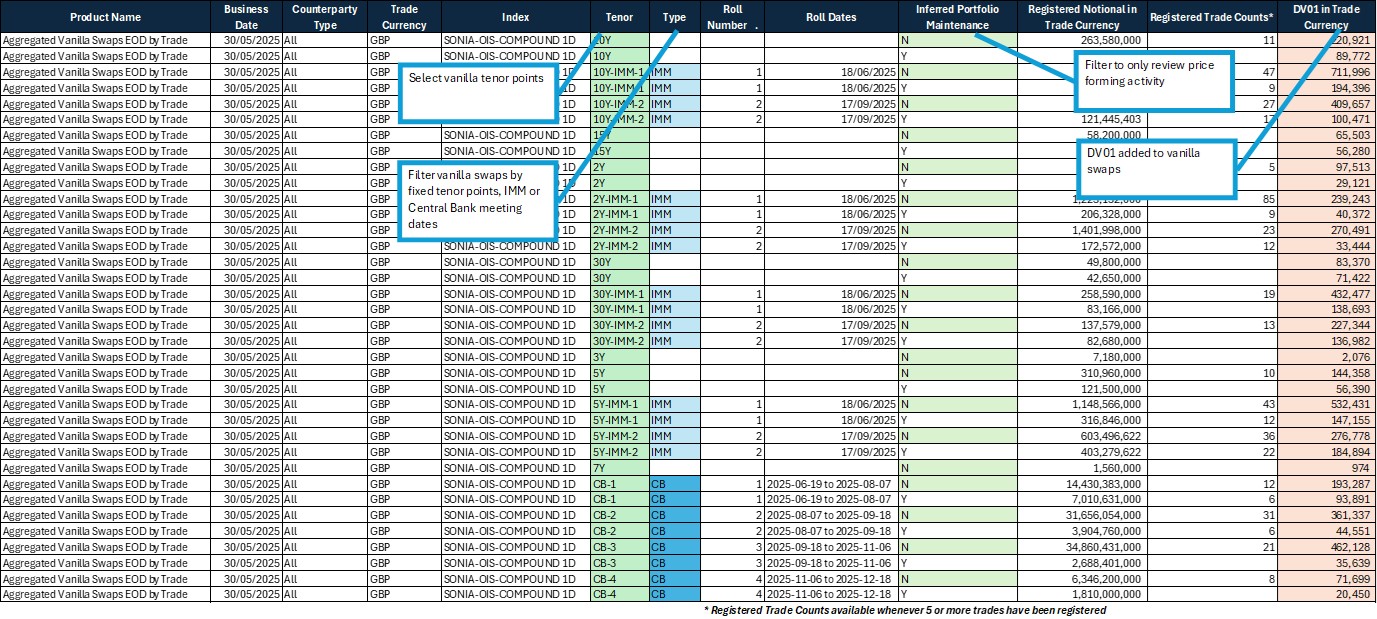

Registered Vanilla Swaps

- Fixed tenor points (1Y, 2Y…10Y, 12Y, 15Y, 20Y… 50Y) for spot starting swaps

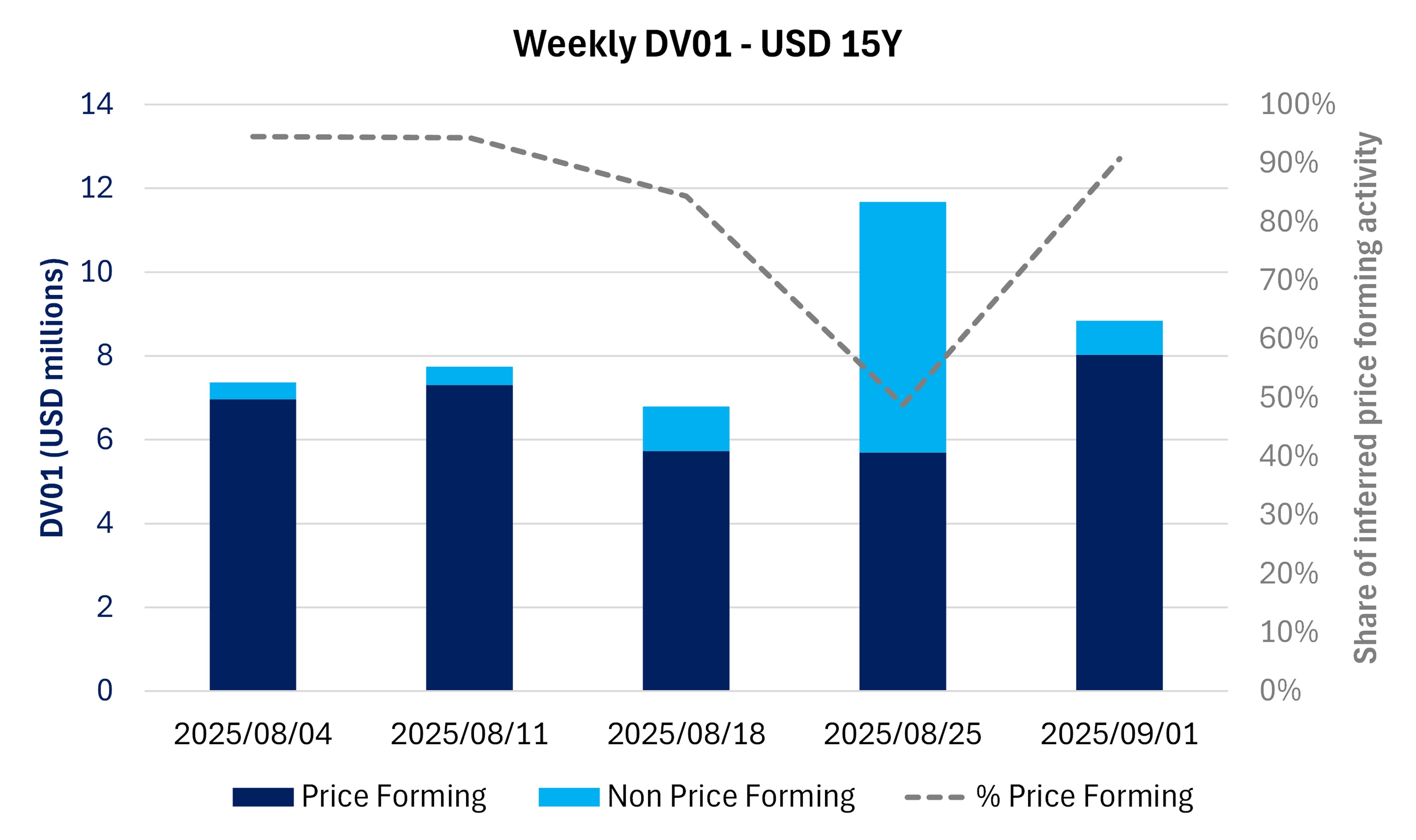

- Daily DV01 for main indices and weekly for all

- Central Bank meeting dates for EUR, GBP and USD. Next 4 rolls available

- IMM dates for the next two rolls for all tenor points

Notional Outstanding

- Outstanding notional at EOD, includes results from compression, netting and blending

- Trade count and notional by currency, product, index and residual tenor bucket

Use Cases

Unlock visibility into daily swap activity and understand market depth, participation types and volume trends.

Identify liquidity trends across currencies and tenors to inform timing and size of your trades.

Use volume data to complement price data for stress tests, liquidity risk models, and to monitor market volatility.

Compare your own trading or portfolio activity against the broader market to gauge performance and coverage.

Data Product Sample

EOD SwapClear Data Volume Product

Excel Sheet Sample

Portfolio Maintenance Activities

Non-price-forming activities such as portfolio maintenance and intercompany transfers can be excluded. This ensures that reported trading volumes more accurately reflect transactions that matter.

Product Integration

LSEG Workspace

- We are now integrated with LSEG Workspace

- If you already use LSEG Workspace, check our data product dashboard using this link: LCH

Free Trial and Product Sample Files

- Join our free trial today and request product samples

- Contact us at ratesproduct@lseg.com