Driving efficiency and reducing risk

Post Trade Solutions enables customers to increase efficiency and optimise capital across the post trade landscape. By connecting with existing cleared infrastructure we bring the benefits of clearing to the bilateral space, driving efficiency no matter where customers choose to trade their risk.

We work with the market to identify pain points so we can provide solutions that materially improve processes and reduce costs. By bringing together three innovative businesses we aim to reinvent the post trade landscape.

Evolving post trade, together

Useful links

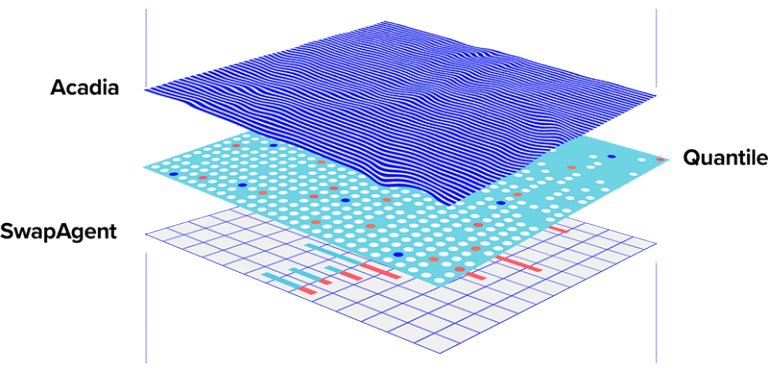

To help you overcome your pain points, we’ve brought together three innovative businesses:

Our solutions

We're better together

To simplify delivery and drive efficiency, we've created five new pillars.

Features & benefits

Why choose Post Trade Solutions

Workflow

Bringing the benefits of clearing to the bilateral space

We’re incrementally transforming post trade

From an ecosystem where each participant:

- Independently stores trade data

- Maintains significant bilateral reconciliation processes

- Supports multiple post trade workflows

To a seamless process where:

- Workflows are delivered through centralised services backed by authoritative trade data

- The process is fully automated

- Risk is reduced while optimising capital and cost

Testimonial

Post Trade Solutions is a great example of how LSEG is helping customers like us to manage risk, comply with increased regulations and optimise capital. In consultation with Goldman and market participants, LSEG is seeking to import best practices and innovation from the cleared markets to the uncleared markets. As a result, I expect that the industry will have much better tools at our fingertips to manage our risk as well as optimise our capital footprint.

Goldman Sachs

Insights

Request details

Want to find out more about our products? Our sales team can provide help and expertise with your queries

Help & support

Already a customer?

Contact LSEG near you

Our compression and optimisation services are delivered by Quantile. View Quantile regulatory information.