8th Annual Sustainable Investment Asset Owner Survey 2025

Each year FTSE Russell conducts a global survey to explore how asset owners are approaching sustainable investment (SI) priorities, strategies and decisions worldwide.

Our latest survey captures market sentiment and uncovers emerging trends. This year’s findings from 415 asset owners across 24 countries reveal:

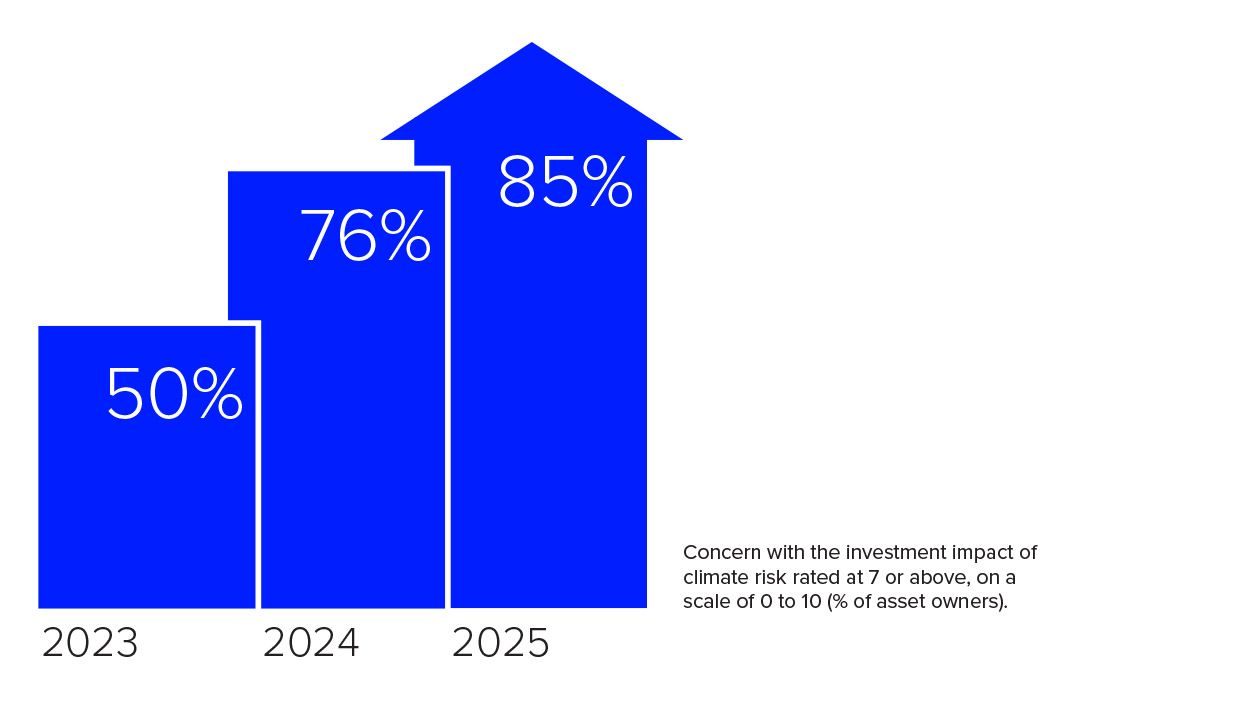

- Rising sustainability concerns: 85% of asset owners identify climate change as a major concern.

- Climate remains the top priority, but diversity and inclusion, and human capital are also rising as priorities.

- Sustained adoption of sustainable strategies: 73% of asset owners take sustainability considerations into account in their investments – a figure that has held steady, despite headwinds.

- Leading motivators: Financial performance (56%) and risk management (54%) have become the primary motivations for SI.

More investors than ever say they are worried about climate risk

Key stats

-

80%of asset owners are incorporating sustainability/climate considerations or using sustainability indices in strategic asset allocation

-

73%of assets owners are implementing SI products in their portfolios, a figure that has held steady, despite headwinds

-

1 in 4asset owners are still assessing whether to implement SI strategies, with greenwashing, ESG data and regulation posing barriers

Who participated in the 2025 survey?

415 asset owners across 24 countries

Regional representation: North America (29%), Asia Pacific (31%), EMEA (40%)

46% pension funds, 16% insurance companies, 16% government-related and sovereign wealth funds, 14% endowments, foundations & family offices and 8% other.

Some 24% of respondents have AUM of US$100 billion or more, 46% have AUM of US$100 billion to US$1 billion, and 30% have AUM of less than US$1 billion.1

Previous asset owner surveys

We now have eight years of insights into the role and impact of sustainability on institutional investors and investment practices. This series provides1 an unrivalled time-series of the evolving attitudes of asset owners towards this key investment trend – and it illustrates its persistence in the face of recent political headwinds and periods of underperformance.