Climate change and its potential implications have been documented for many years. The global economy is shifting towards a more sustainable, low-carbon future to uphold the Paris Agreement and limit the increase of global temperatures to well below 2°C.

To transition to a low-carbon economy, you need data to measure and decarbonise your portfolios, identify climate risks and opportunities, and report with confidence in line with regulations that are becoming mandatory and expanding globally.

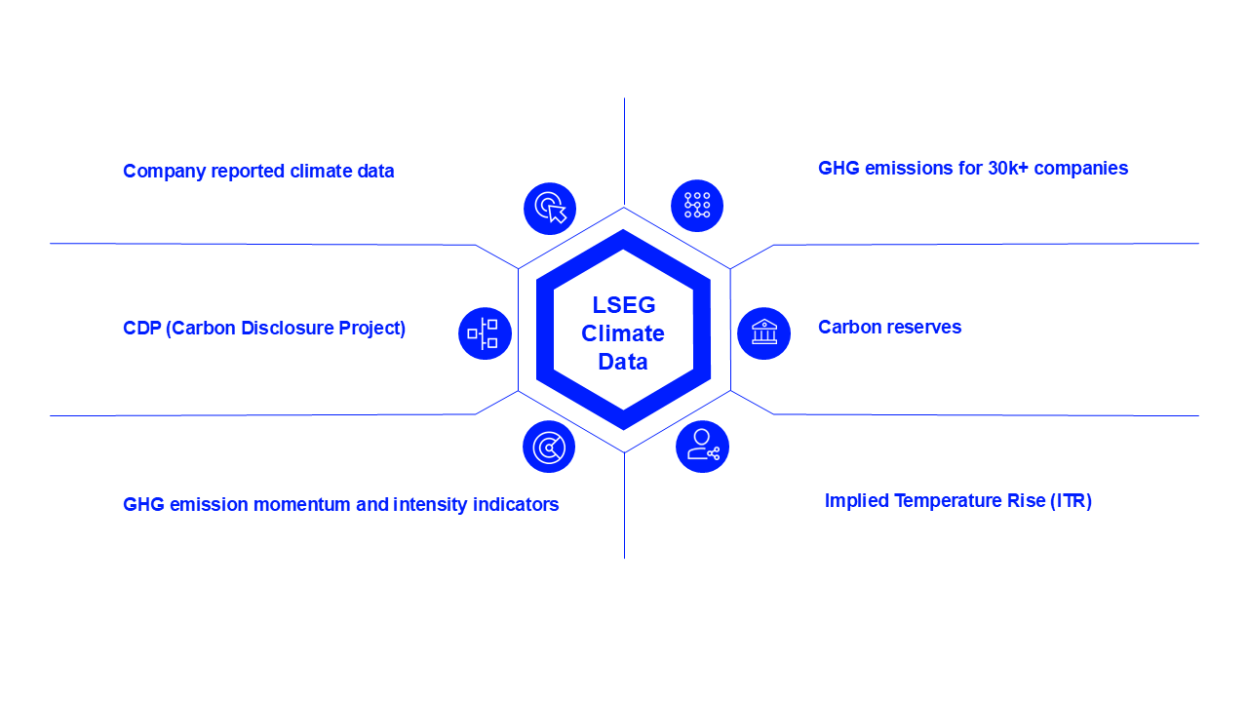

At LSEG, we deliver high-quality, verifiable climate management, ambition and performance (Climate MAP) data to help you navigate the complexity of the climate transition on your business and portfolios.

Our comprehensive Climate MAP data covers three core pillars:

- Management: a company’s governance of the transition to net-zero.

- Ambition: companies’ commitments and future ambition towards decarbonisation.

- Performance: companies’ actual performance towards climate change targets.

Our climate solution now includes Implied Temperature Rise (ITR) data, based on NGFS scenarios, enabling businesses and investors to assess companies’ alignment to their sectoral pathway.

To complement LSEG climate data, customers can subscribe to TPI Management Quality Scores data which assess companies’ climate governance activities in line with TCFD recommendations.

-

18.5k+Total companies (as-reported data)

-

60kTotal companies (estimated data)

-

880+Metrics

-

from 2002History

-

1,500+Quality checks

How we help

Driving sustainable growth with trusted climate data

LSEG has one of the most comprehensive and market-leading climate data sets in the industry, supporting customers to meet their financial and sustainability objectives, while avoiding greenwashing.

LSEG climate data provides you with a vast set of company reported climate data measures aligned with the latest disclosure standards, sophisticated analytics and innovative estimated emissions models, Implied Temperature Rise data and complementary third-party climate data. Customers can subscribe to TPI Management Quality Scores, which measure the quality of companies’ climate transition governance and commitments. Our climate data empowers you to have confidence in investment decision making and regulatory reporting.

As a sustainable finance industry leader, we utilise our data and expertise to continually invest in knowledge sharing and collaborate with our customers and industry partners globally. We continuously innovate and invest in capex to keep our data products relevant and aligned with the latest development in the industry.

Use Cases

Our climate data helps the industry on the journey to net zero:

Manage climate risks by identifying companies that have:

- Transition plans and GHG emissions reduction targets

- Robust governance in place to manage climate risks

- Reported emissions performance data

- Stranded assets

Develop investment strategies with climate objectives

- Identify companies that are well-positioned to thrive in a low carbon economy

- Screen for companies that are heavily exposed to climate risks

- Develop new and differentiated climate strategies and investable solutions to acquire market share amongst climate mandates.

Regulatory reporting & public disclosure

- Report on the sustainability impact of investable products with consistent and comparable data

Invest with a climate-related focus

- Identify investment opportunities based on emissions data

Advisor-lead investing

- Incorporate climate performance into your advisor dashboard

Portfolio creation and management

- Build portfolios with a climate focus and monitor their performance from a climate risk perspective

Climate reporting

- Report against climate reporting frameworks, whether voluntary or compulsory

Advise clients on climate-related challenges and opportunities

- Encourage and assist your customers to substantially reduce production of GHG’s by providing advice on reduction and adaptation

Develop new climate-linked financial products and services

- Help your clients invest in climate-friendly assets and manage their climate risks

Transition the lending book in line with net zero targets

- Meet regulatory reporting obligations and transition net zero in your own operations

Energy transition and carbon footprint analysis

- Finance low-carbon ecosystems across the energy supply and infrastructure spectrum through renewable financing

Climate reporting

- Report against climate reporting frameworks (including TCFD)

Sustainability strategy and risk management

- Understand the carbon emissions in your supply chain to set your sustainability strategy and work with suppliers to reduce GHG emissions

Opportunity identification

- Assess your climate performance and understand how your performance compares to industry peers.

Benefits

We provide comprehensive company targets data based on the latest disclosure standards

We provide full auditability of the underlying data and source documentation for all as-reported data across all historical periods. Capturing restatements for up to five years

Our hierarchical, multi-model approach provides data with improved accuracy and reduces the risk of underestimating emissions.

We provide comprehensive company transition plans and targets data based on the latest disclosure standards

Our expert climate researchers, data scientists and thought leadership content have a proven track record

Insights

Solutions

Discover our sustainable finance services and solutions

Our extensive climate data is available via:

- LSEG Workspace - our market-leading ecosystem of insights, news and cutting edge analytics

- LSEG data platform - our cloud-native solution which uses the latest technologies to ensure highly scalable, resilient and secure delivery in CSV and JSON formats

- Snowflake - a cloud-based data platform that enables you to store, process, analyse and share any type and amount of data with ease and efficiency

Request details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576