A smarter way to manage risk instantly

Risk Analytics Lab is a cutting-edge new platform which can instantly generate risk and pricing calculations. By combining the power of the Open-Source Risk Engine with the speed and simplicity of SaaS, we are delivering a smarter, faster and more collaborative approach to managing risk.

Risk Analytics Lab enables

Complex analytics to be run in one simple step

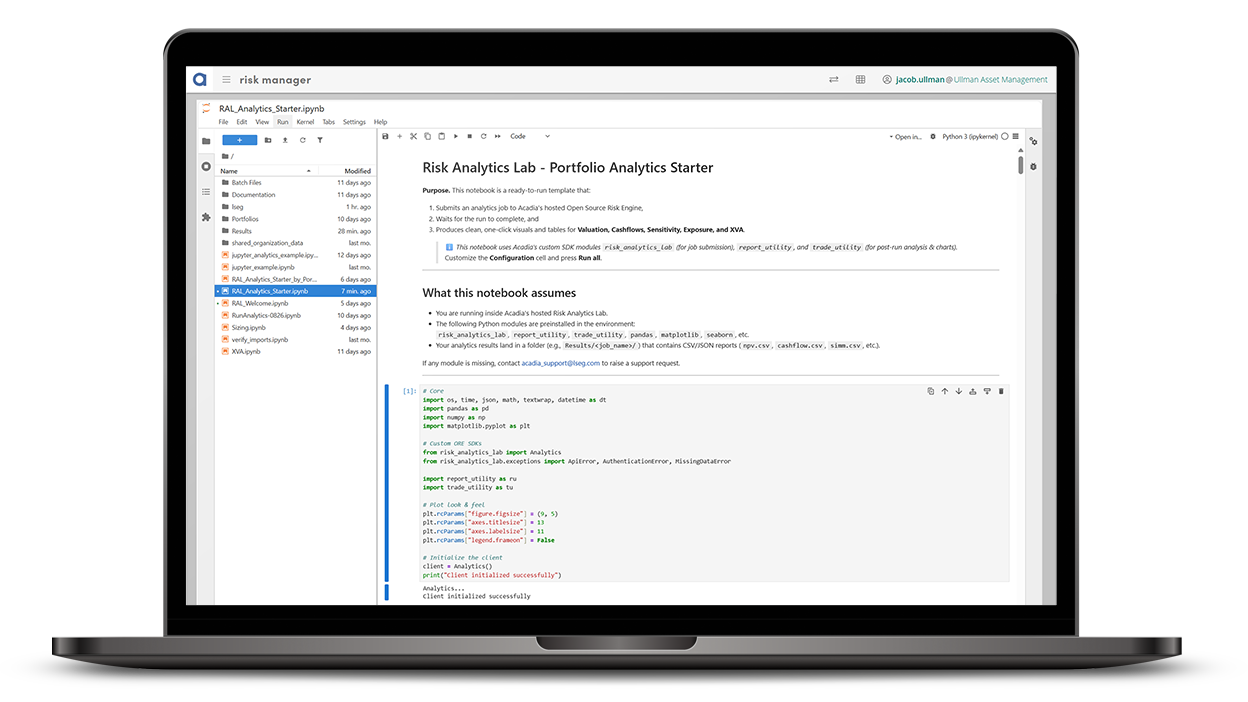

Risk Analytics Lab removes the need for lengthy integration projects or custom setups. With a familiar Python notebook interface and direct access to trade and agreement data, users can script their own analysis and generate results immediately.

Access to integrated market data and workflows

Preconfigured bootstrapping and correlation workflows, combined with integrated market data, allow users to perform risk calculations across their portfolios without delays or manual configuration.

Total transparency via open-source

Powered by the Open Source Risk Engine (ORE), every line of code and configuration is open for review and adjustment. This gives firms full control and confidence in their analytics, while enabling fast onboarding and long-term flexibility.

Collaboration, scalability, innovation

Delivered via SaaS, Risk Analytics Lab supports dynamic scaling and seamless collaboration. It’s a platform built for the risk teams, enabling faster innovation, clearer insights, and immediate value.

Features & benefits

Key benefits

Access trade and agreement data instantly, no need for full trade integration. Risk Analytics Lab connects directly to Post Trade Solutions’ data stores, enabling fast, frictionless analytics from day one.

Use a familiar Python notebook interface to script custom risk analysis. Build, adapt, and extend models with full control, enabling tailored workflows and deeper insights.

Start fast with proven default setups built on the Open Source Risk Engine (ORE). Deliver immediate value while retaining full transparency and flexibility to customise.

Run complex analytics efficiently with queued calculations. Handle large workloads seamlessly and scale across teams without compromising performance.

Automate your workflows with scheduled or reactive runs. Trigger calculations based on data changes and keep your analytics continuously up to date.

Our free entry tier lets you experience Risk Analytics Lab at no cost, so you can demonstrate value and get results immediately without full trade integration or upfront investment.

How it works

Risk Analytics Lab in action

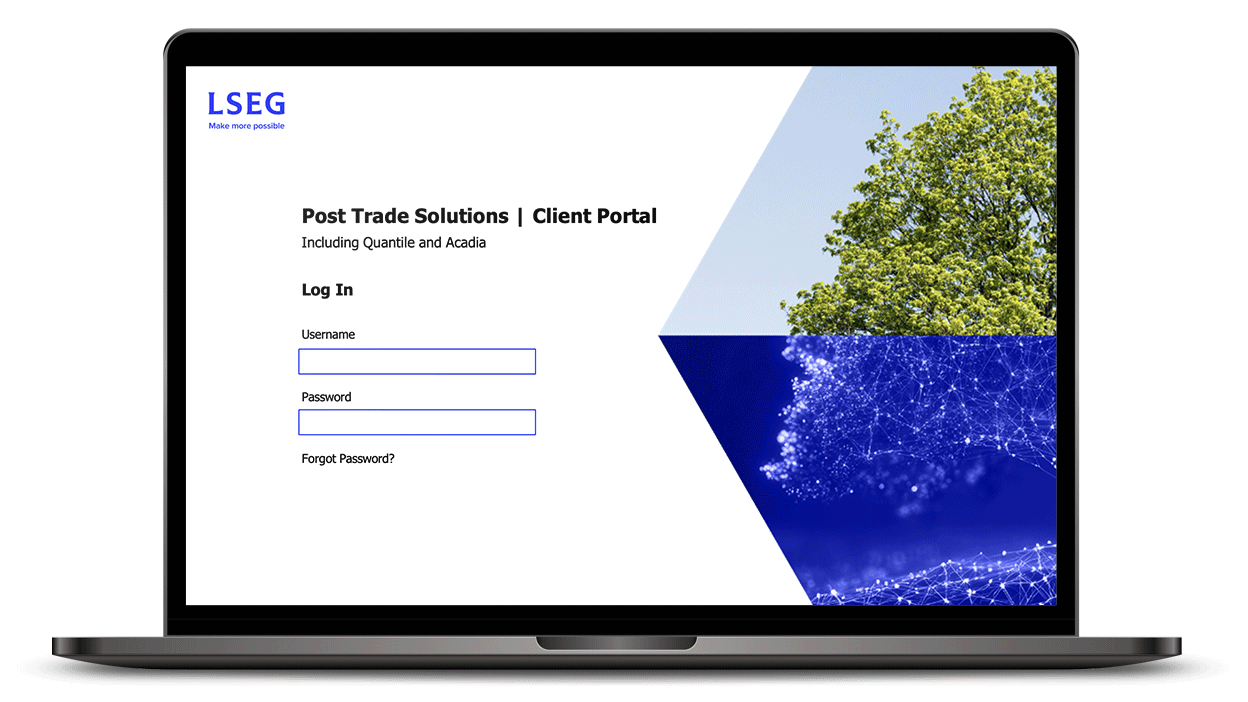

Launch instantly via SaaS

Risk Analytics Lab is delivered through AcadiaPlus, enabling immediate access without the need for installation or complex integration. Teams can start analysing risk from day one.

Connect to integrated data sources

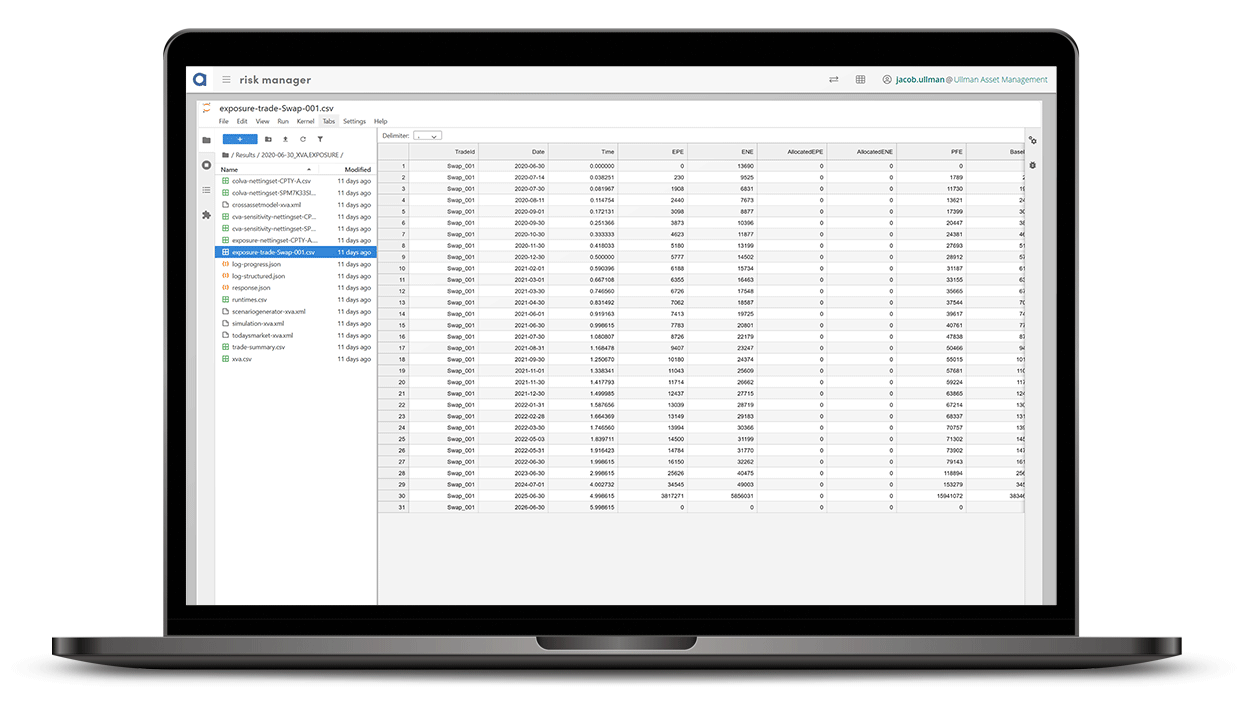

Users gain direct access to trade and agreement data, CSA terms, and over 15 years of cleansed market data. This includes live snapshots and historical datasets for pricing, calibration, and backtesting.

Script and customise your analysis

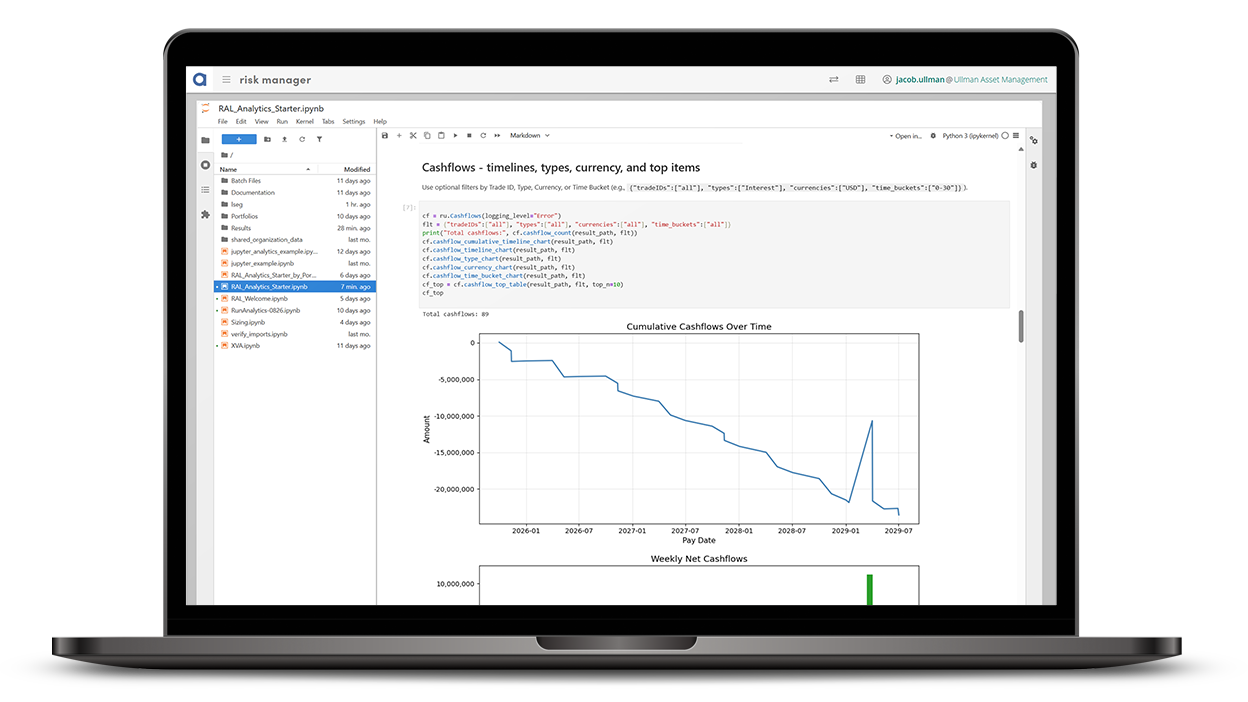

Work within a familiar Python and Jupyter notebook environment. Use prebuilt examples or create custom workflows using SWIG interfaces and Acadia APIs. Auto-documented notebooks capture every step for transparency and auditability.

Execute calculations at scale

Calculations are distributed across a scalable cloud infrastructure. Jobs are queued, scheduled, and processed efficiently, even long running tasks continue after logout. Users can tag jobs for specific resource needs or request dedicated machines.

Perform advanced analytics

Run pricing models using stochastic processes, American Monte Carlo, and lattice methods. Conduct xVA simulations, model validation, stress testing, and sensitivity analysis, all within a flexible, open-source framework.

Extend and integrate

Risk Analytics Lab supports secure file uploads, reactive job execution, and integration with downstream systems. Firms can share data via LOA and build around the platform without vendor lock-in.

Driving the derivatives industry forward

We offer more than just Risk Analytics Lab. Find out how we can Analyse your portfolio.

Insights

Request details

Want to find out more about our products? Our sales team can provide help and expertise with your queries