Daniel Flowe

- Identity verification has become a sticking point for the financial sector, as consumers’ expectations of the onboarding process shift and providers look for more efficient ways to conduct secure identity checks.

- A potential solution is reusable identity technology, already used by several governments.

- Implementation will need a high degree of interoperability between technology frameworks, substantial investment in infrastructure, and collaboration between public and private entities.

For banks and financial services, digitisation provides a host of opportunities to enhance the customer experience and attract and retain more customers. Customer behaviour is changing, consumers increasingly search for convenience and personalisation from their financial services provider, which has put identity and verification under the spotlight. The usual verification process is too impractical to be compatible with current corporate goals or customers' expectations and new concepts of identity that provide quick, secure and efficient verification are required.

Financial organisations are investing in innovative verification methods using a combination of biometric, multi-factor, identity-based, or knowledge-based authentication. These new methods offer increased convenience and speed, but inefficiencies still exist. With the customer onboarding process now a significant competitive differentiator, many financial institutions are preoccupied with resolving these inefficiencies. The rewards will be great, with studies showing that 68% of European consumers have abandoned an application for a financial service in a year, primarily because of the length of the process, and 52% of onboarded consumers are less likely to use a company's service after a negative onboarding experience[1].

The financial sector needs a verification process that will allow them to enhance and personalise the customer onboarding process while enabling them to meet their increasingly complex and demanding regulatory obligations. One solution, reusable identity technologies has emerged as a potential option for the finance sector.

Reusable digital identity

A reusable digital identity is a single standardised digital identity that multiple platforms or services can access for details, as the user permits. A trusted authority verifies credentials to authenticate identity and enables users to access multiple applications with a single sign-on (SSO).

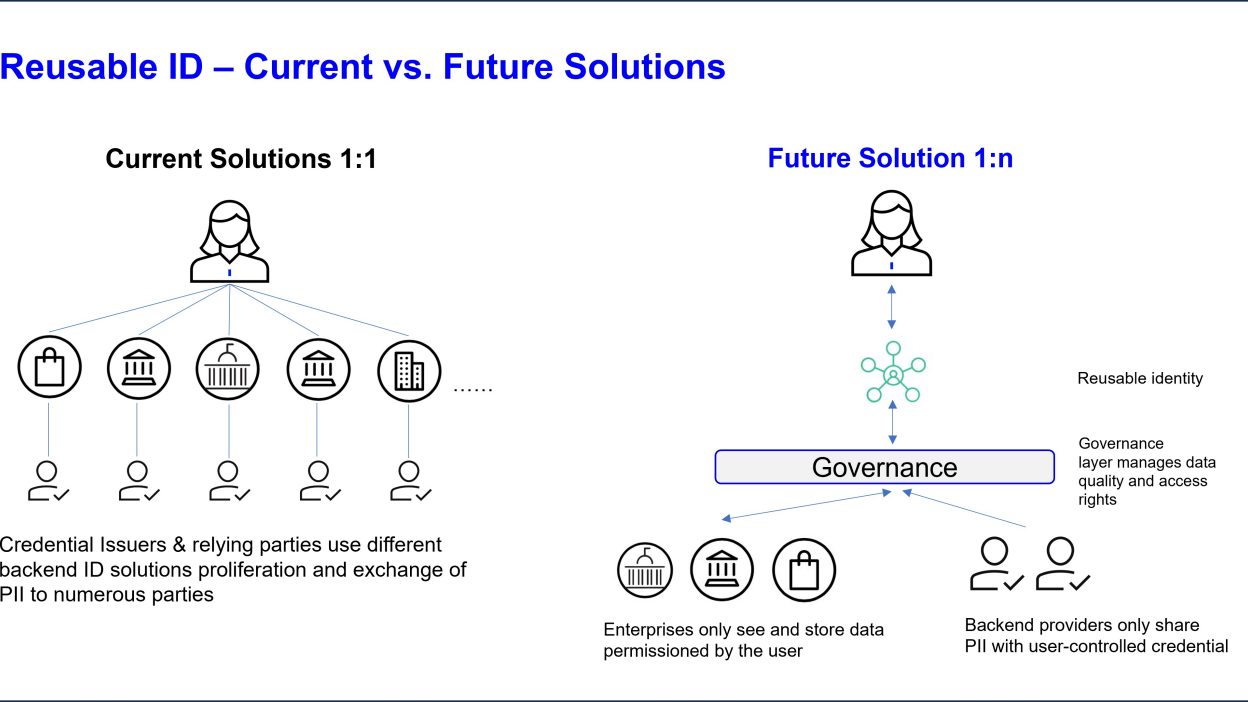

Most digital identity solutions are standalone or one-to-one, compelling consumers to verify their identity separately for each transaction. Consumers are left managing multiple accounts and passwords, and organisations are obliged to build or buy a unique identity verification platform.

The many-to-many, or N:N, relationship model provides unique identifiers for entities that can be used across different contexts and interactions. A reusable digital identity solution allows consumers a single sign-on to a federated identity held in a secure cloud application. SSO is already used by a few social media accounts, with consumers comfortable signing on once and accessing multiple accounts.

Reusable ID – Why do we need it?

Digital identity is undergoing rapid transformation: Consumer-centric solutions are going mainstream, and there is increasing demand for interoperable identity credentials that can be used across the digital and physical world.

Source: Unlocking the Potential of Future Identities, Liminal.co, April 5, 2021

The identity can include any combination of personal information that meets verification requirements as long as it can be substantiated and is acceptable to the verification authority. The benefits are apparent:

- A simpler sign-in process

- Increased convenience

- Standardisation of data

- Enhanced customer experience

Increasing use

Several governments have launched reusable digital identity strategies to broaden access to services for their citizens. India, for example, has more than 1.3 billion electronic identities. Estonia, one of the first countries to adopt an electronic digital identity system in 2014, has an adoption rate of 99%[2]. In Europe, the EU plans to launch an interoperable European Digital Identity Wallet (EUDI) framework that will allow EU citizens and businesses to share identity data needed to access certain digital services such as opening bank accounts, airport check-ins, car rentals and so on[3]. Each EU member will be required to create at least one national wallet application. Although consumers will not be mandated to use these wallets, the move should help resolve the current fragmented identity credential environment.

The private sector will be watching the success and progress of these initiatives with interest. For banks and financial services, considerably impacted by their sector's profound transformation and fragmentation, the search for a user-friendly, robust verification method is particularly critical. The banking business model is changing rapidly as new, digital-only competitors offer micro-niche bank services products, fragmenting a fast-changing market.

Digital-only financial services can be more responsive to changing customer expectations, and by providing frictionless, personalised experiences, the new entrants can penetrate old markets and create new markets.

In this increasingly competitive environment, the need for innovative verification technology is apparent, but obstacles to implementation will need to be addressed.

Challenges

Seamless interaction between banking entities requires a high degree of interoperability. Different identity systems should be able to interact with each other faultlessly, without security issues, and offer strong privacy controls. It will require a substantial investment in technology infrastructure, standardisation and stakeholder collaboration.

Investment into the technology by the private sector is already happening, with Apple and Google launching solutions very recently. However, without relevant regulation, progress will be slow. Currently, the progress of reusable identity technology is being managed almost entirely by the public sector, emphasising the need for private-public collaboration.

It will be worth the investment and work. Reusable identity offers significant opportunities for innovation and growth in the financial sector. It offers incredible potential to deliver convenience, create new markets, and encourage economic growth.

1. Record number of European consumers abandon financial applications during onboarding, Signicat.com, March 30 2022

2. The Global Rise of eIDs, LSEG

3. European Digital Identity Wallets: Commission publishes first technical Toolbox towards prototypes, European Commission, February 10 2023

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2024 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.