Silvina Bruggia

The global financial industry has adopted ESG factors as part of the standard investment decision process. Emerging markets are following this trend at a different pace. However, data disclosure and availability are still proving challenging.

- The lack of data and consistency in emerging markets is the main barrier to faster sustainable finance adoption. While we have noticed a significant improvement in data availability, there is still some work to do.

- Data is the bridge that connects ESG investments with emerging economies and it is the key driver in achieving Sustainable Development Goals.

- While adopting global standards can be considered a big step forward, ESG should be valued in the local context. It is important to consider “what good performance looks like in emerging markets”.

The opportunity for emerging markets

The global financial industry has adopted ESG factors as part of the usual investment decision process. According to the latest edition of the FTSE Russell global survey, sustainable investment is now mainstream across the globe, as 86 percent of asset owners are implementing sustainability into their portfolios.

In parallel, there has been increasing collaboration between key stakeholders towards attaining a comprehensive global baseline for sustainability disclosure standards. This was evidenced by the creation of the International Sustainability Standards Board (ISSB) a year ago.

Emerging markets are following this trend at a different pace, but progress is a fact in almost all countries.

A recent report published by PRI highlights the drivers to investment in emerging markets. Institutional Investors choose to invest in emerging markets for several reasons, including to gain exposure to growing economies, portfolio diversification and to have a positive impact on the country’s development.

This represents an incredible opportunity for many countries to attract capital and accelerate growth, as well as to support the transition to a low-carbon economy.

The benefits of companies implementing a sustainable strategy are recognised globally. From identifying new opportunities for revenue generation to enhancing reputation, reducing operational and financial risks, and accessing lower cost of capital.

An important factor should be considered when we talk about developing economies: ESG disclosure helps to dissipate the noise of short-term shocks and to better demonstrate the long-term potential.

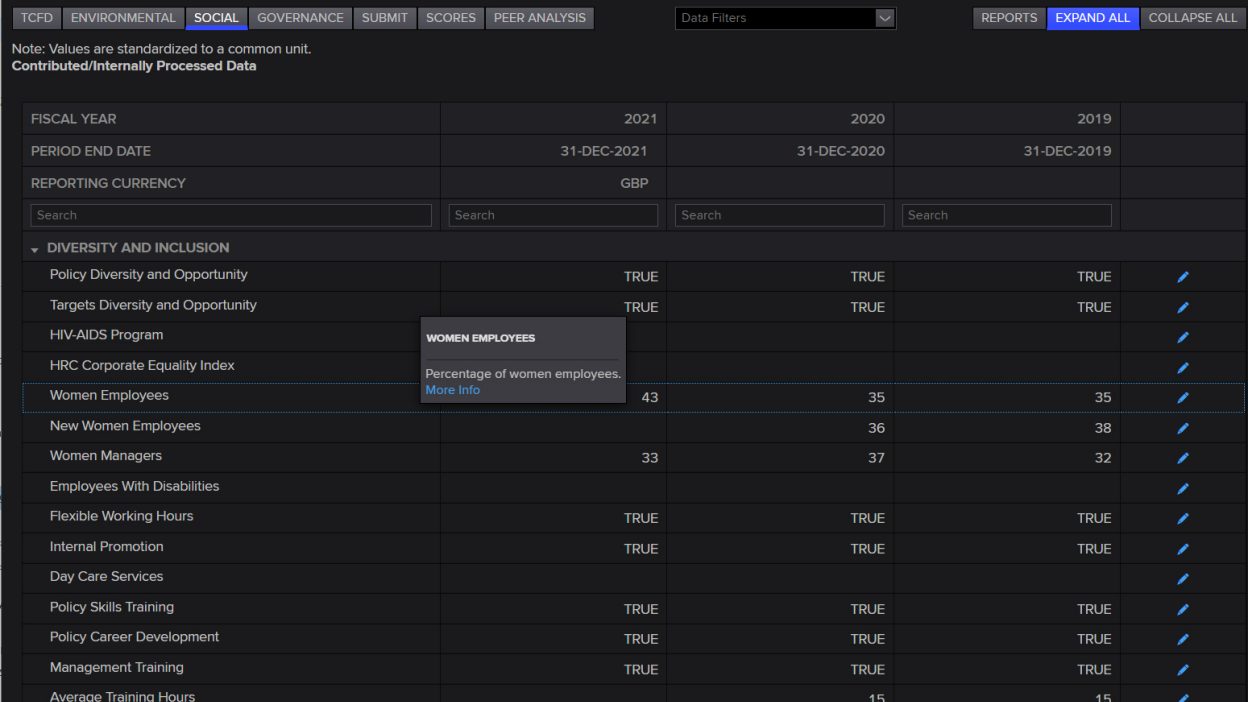

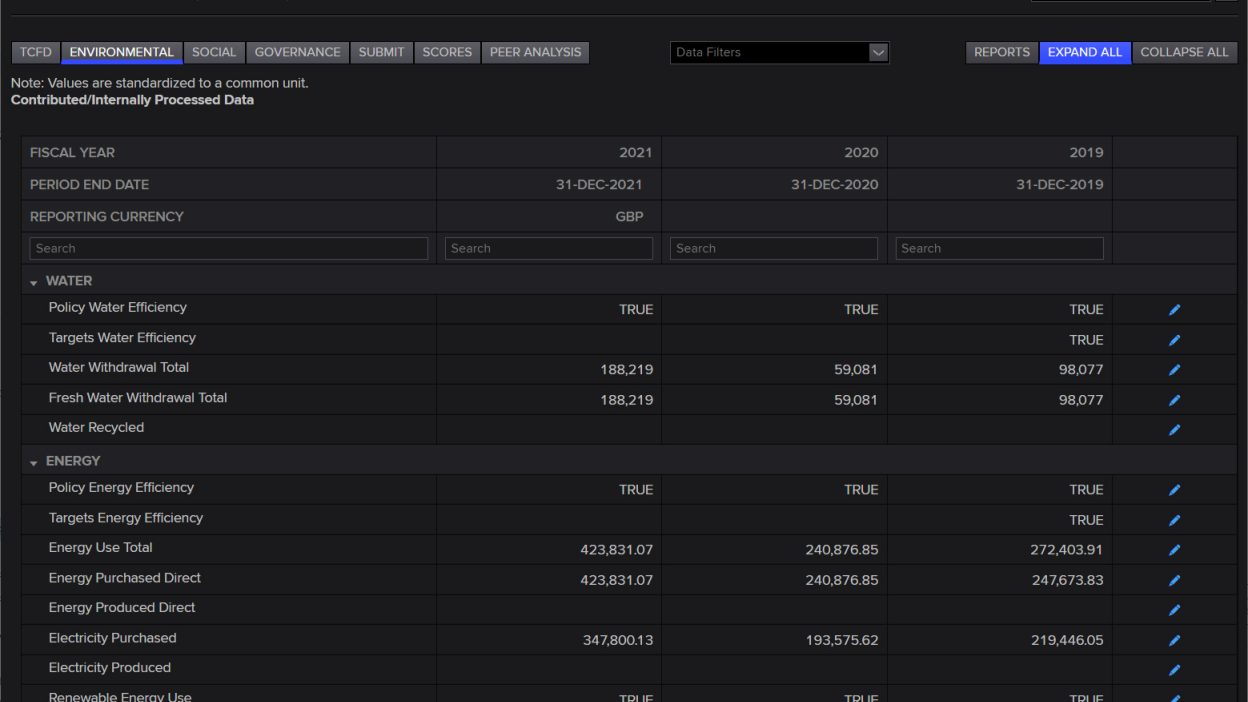

ESG Contribution Tool

The challenge of data availability

Data is, in essence, the bridge that connects ESG investments with emerging economies and it is the driver to progress towards Sustainable Development Goals achievement.

The efforts of regulators and Stock Exchanges in stabilising frameworks and providing guidelines for better corporate disclosure are paying off.

In many countries like Malaysia, Thailand, Philippines, South Africa, Morocco, United Arab Emirates, India and China, we have noticed a significant improvement in data availability.

However, there is still some work to do.

The lack of data and consistency in emerging markets could be identified as the main barrier to faster sustainable finance adoption and fund inflows. Together with a robust and comprehensive database to build on, indexes and analytics support and inform investment decision-making.

How do we accelerate the content creation process?

Collaboration and deeper engagement between the financial community participants is key. A good example of this in practice is the BIST Sustainability Index, where advanced technology and global best practices allow a faster and more accurate company sustainability assessment. Therefore, market information is more relevant.

This index, which will be followed by others, intends to facilitate investing in sustainability for Borsa Ístanbul investors.

Listed companies in Turkey are invited to update their sustainability data through the ESG Contribution tool, a free, self-service workflow platform, that allows companies to make their ESG impact known globally.

Moreover, this is a communication channel between companies and the Refinitiv research team as well as the content experts. This makes the reporting task easier, as companies can find a guide on material data points that are relevant for investors. At the same time, this ensures data users have access to the timeliest, verified, and comparable data on individual companies.

ESG Contribution Tool

The future

While adopting global standards can be considered a big step forward, ESG should be valued in the local context. Current taxonomies are a benchmark that emerging markets can build on.

During the sixth edition of the Future Investment Initiative (FII) Conference that took place in Saudi Arabia last October, participants had the opportunity to deep dive into this idea. The FII Institute invites investors to integrate the Inclusive ESG Framework and Scoring Methodology into their decision-making.

The assessment tool, which is the outcome of several interviews with leading investors by EY, addresses the question of “what good performance looks like in emerging markets”.

Having a more holistic approach that considers challenges on social and governance factors, as well as country risks and opportunities, contributes to a virtuous circle where the visions and commitments at the national level have a positive influence on the sustainable strategies defined by companies. This ultimately also attracts more international and local investment.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2023 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.