Wealth Data Solutions team

Dr. Richard Peterson

In today’s hyper-connected markets, the challenge isn’t finding information - it’s filtering out the noise. With AI-generated headlines, social media buzz, and robo-commentary flooding every trading day, wealth managers and advisers need tools that can distill meaningful signals from the noise. LSEG MarketPsych Analytics transforms unstructured global chatter into structured, predictive insights - helping wealth professionals stay ahead of market-moving themes and sentiment shifts. In this insight we explore how to:

- Spot the signal early: Monitor emerging macro and thematic catalysts—like tariffs or AI developments—and identify which stocks are likely to benefit or suffer before the market fully reacts.

- Enhance portfolio precision: Use sentiment-driven rankings to tilt toward high-conviction names and away from underperformers, improving risk-adjusted returns with data-backed confidence.

- Strengthen risk and client experience: Detect sentiment drops as early warning signs and turn complex analytics into intuitive visuals that resonate with customers.

Every trading day brings an avalanche of “information”: AI-generated news releases, auto-summarised earnings blurbs, eyeball-chasing social posts and an ever-growing stream of robo-commentary. For wealth managers and financial advisers, the problem is no longer a shortage of data but a glut of low-value noise masquerading as useful insight. The challenge is two-fold: first, to identify the handful of macro and thematic catalysts that truly sway asset prices; and second, to connect those themes to the individual stocks that are most likely to benefit - or slide - in the weeks ahead.

Themes are driving markets

Market history shows that narratives periodically dominate investor psychology. Investor sentiment in the first half of 2025 was shaped by escalating trade-war rhetoric, new tariff measures, notable progress in Chinese AI capabilities, and a weakening US dollar. In each case, share-price reactions were swift, but not uniform: companies perceived as winners surged, while those cast as casualties lagged. For portfolio stewards, the goal is to spot theme-related sentiment shifts early enough to rebalance exposure before the price trend is exhausted.

From unstructured text to structured signal

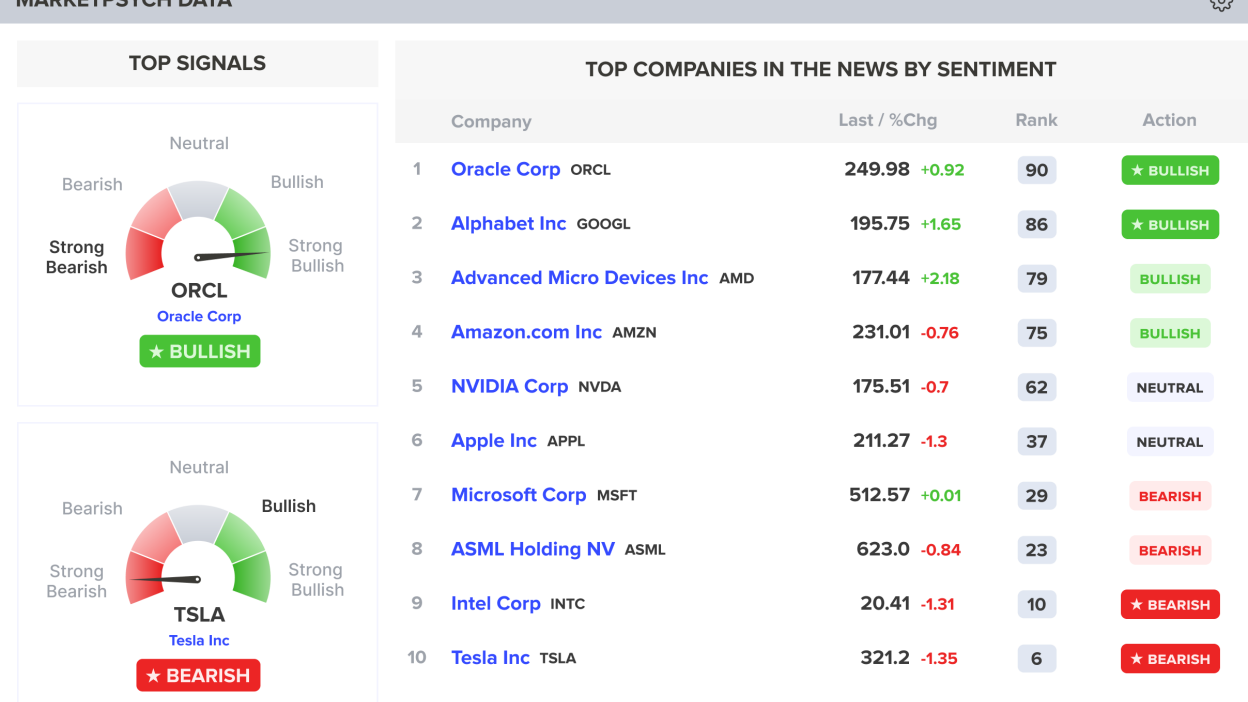

To dial down the noise and boost decision-making quality from AI, LSEG MarketPsych Analytics and Models uses robust news and social media analytics, coupled with strong data governance, symbology frameworks and data transparency. LSEG MarketPsych Analytics software ingests millions of articles, posts and transcripts each day, classifying them by company or asset class and more than 200 economic and behavioural themes (see MarketPsych: NLP & Predictive Analytics in Finance | LSEG). Each mention is scored for intensity and direction, producing minute-level sentiment and thematic indices across 100,000-plus global equities. The resulting data feed can be streamed directly into dashboards or systematic models, giving advisors and clients an at-a-glance view of how a headline is resonating across the market, as seen in Figure 1 below.

Evidence that sentiment leads prices

Quantitative tests run on these sentiment scores demonstrate that media and social tone is not just descriptive - it is predictive. In a 20-year back-test covering more than 4,000 U.S. stocks, the decile of shares with the most positive one-month media sentiment outperformed the most negative decile by a meaningful margin over the subsequent three months (see Figure 2). This result is seen globally, and it appears strongest in India. This signal has strengthened in the past five years, demonstrating the increased power of media in driving stock prices.

The above finding is the foundation of a stock price prediction model that has been successfully producing meaningful predictions for several years. By combining sentiment with other media signals, such as ‘innovation’, ‘layoffs’, and ‘management sentiment’, the StarMine MarketPsych Model, converts raw sentiment and thematic indicators into a simple 1-to-100 daily ranking for each stock. The StarMine MarketPsych Model has shown an average 10% annual spread between the top-ranked and bottom-ranked deciles of U.S. stocks since it launched.

Practical applications for wealth advisors and clients:

- Theme monitoring: Set alerts for spikes in tariff-related or AI-related sentiment at the market, sector or company level. Quickly assess which companies are most at risk in a portfolio or watchlist when a theme re-emerges.

- Idea generation & portfolio construction: Tilt toward high-sentiment names and underweight low-sentiment peers within a sector. Even slight sentiment bias can meaningfully improve risk-adjusted returns.

- Risk management: Sudden drops in aggregate sentiment - often invisible amid headline noise - can act as an early-warning system for profit-taking or earnings disappointments.

- Client communication: Visual aids such as the sentiment-price chart and thematic heat-map turn complex Natural Language Processing outputs into intuitive storytelling devices that resonate with end-investors.

A disciplined lens, not a crystal ball

Sentiment and thematic data should complement - never replace - fundamental analysis and valuation work. Moreover, past outperformance of high-sentiment stocks does not guarantee future results. But in a world where the signal-to-noise ratio is deteriorating by the hour, tools that transform unstructured text into structured, empirically validated indicators give advisers a measurable edge.

Wealth managers, traders, and investors worldwide rely on LSEG MarketPsych Analytics and Models to cut through the noise and uncover actionable insights—even during periods of heightened market volatility. By integrating sentiment and thematic scores into your research and risk workflows, you can spend less time parsing headlines and more time acting on the signals that truly move markets.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2025 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided "as is" without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights ("IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.