Advancing with a unique and customised workflow solution

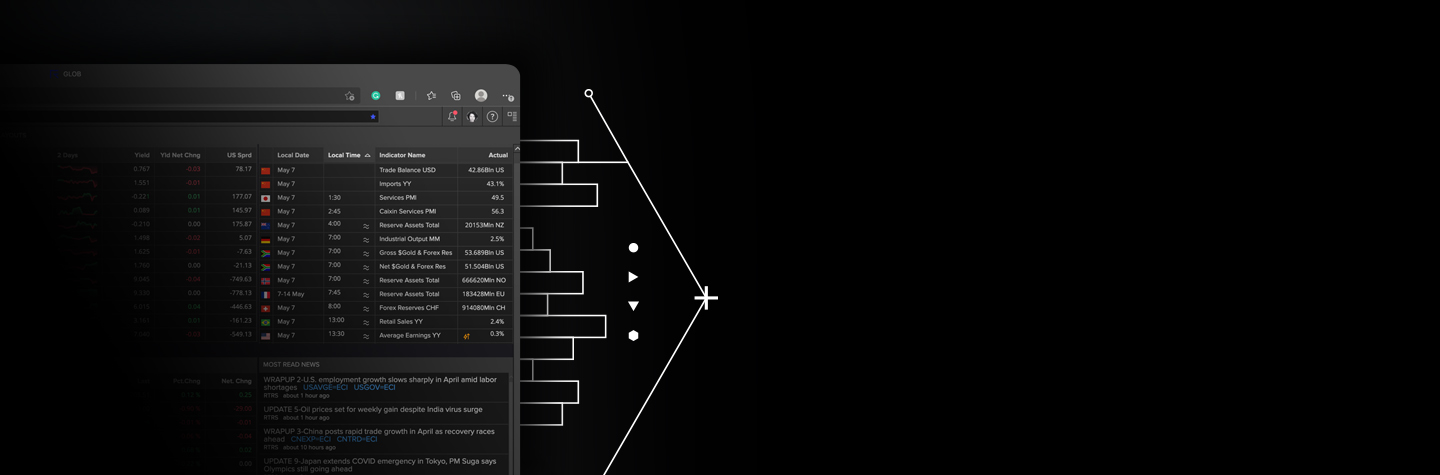

Access the content and functionality you need in a rapidly changing and competitive market with Workspace, designed for the future of equities trading.

Whether you’re looking for news with qualitative insights or predetermined stock-level quantitative data, Workspace gives you unparalleled access to timely, relevant trading cues you need at a moment’s notice. You’ll get transparent oversight of value chains, across suppliers, customers, estimates, sectors, peers and index analysis. You can also leverage real-time granular insights across all asset classes.

With a single point of access to information, you can integrate these insights into your equity-trading workflows – making it easier to spot opportunities and gain a competitive edge.

Insights you can rely on

Always available, wherever you are.

Explore 50 million instruments/indicators (13 million economic indicators) across all asset classes with 70+ years of data, spanning 175 countries. Leverage the information and tools you need to interpret market trends, economic cycles and the impact of world events using advanced charting tools and technical analysis.

Get exclusive access to trusted Reuters News and more than 10,000 other authoritative sources in multiple languages, plus broker research from over 1,300 sources.

Search for market depth and related analytics with an updated Blended Order Book. Leverage a modernised options and futures analytics engine, and composite pricing and volume data to find a last price and total volume across multiple venues for fungible securities.

Benefit from various new calculators for historical return analysis, correlation and regression including Option Watch, Option Pricer, Surface Volatility and Most Traded Options.

Workspace’s hybrid analytics let you use your in-house pricing and analytics alongside LSEG content. Build customised pricing models using our data APIs and access asset class-specific trading applications.

As Workspace adapts to your workflow, enjoy seamless access to the apps and tools most relevant to you. You’ll get to the data and insights you need with fewer clicks, thanks to intelligent search powered by structured and natural language capabilities.

Features & Benefits

What you get with LSEG Workspace for equities

Powerful cross-asset data and analysis

Access 50 million instruments/indicators across all asset classes, plus 70+ years of data, spanning 175 countries.

Summary Overview (SOV) provides key pricing, estimates, fundamentals, news and other data for a given company.

Innovative trading tools

Use updated calculators for historical return analysis, correlation and regression, as well as an updated Blended Order Book to help you find market depth and related analytics.

Watch instruments and multiple portfolios across all asset classes in real time with Monitor (MON).

Modernised options and futures analytics engine

Find the most traded contracts and historical volatility surfaces for equities and equity indices.

Access Options analytics with real-time derived attributes such as implied volatility and greeks for individual options strikes, as well as extensive at the money volatility indices and volatility surfaces by delta and moneyness.

Request product details

Email your local sales team

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576