The integrated software package

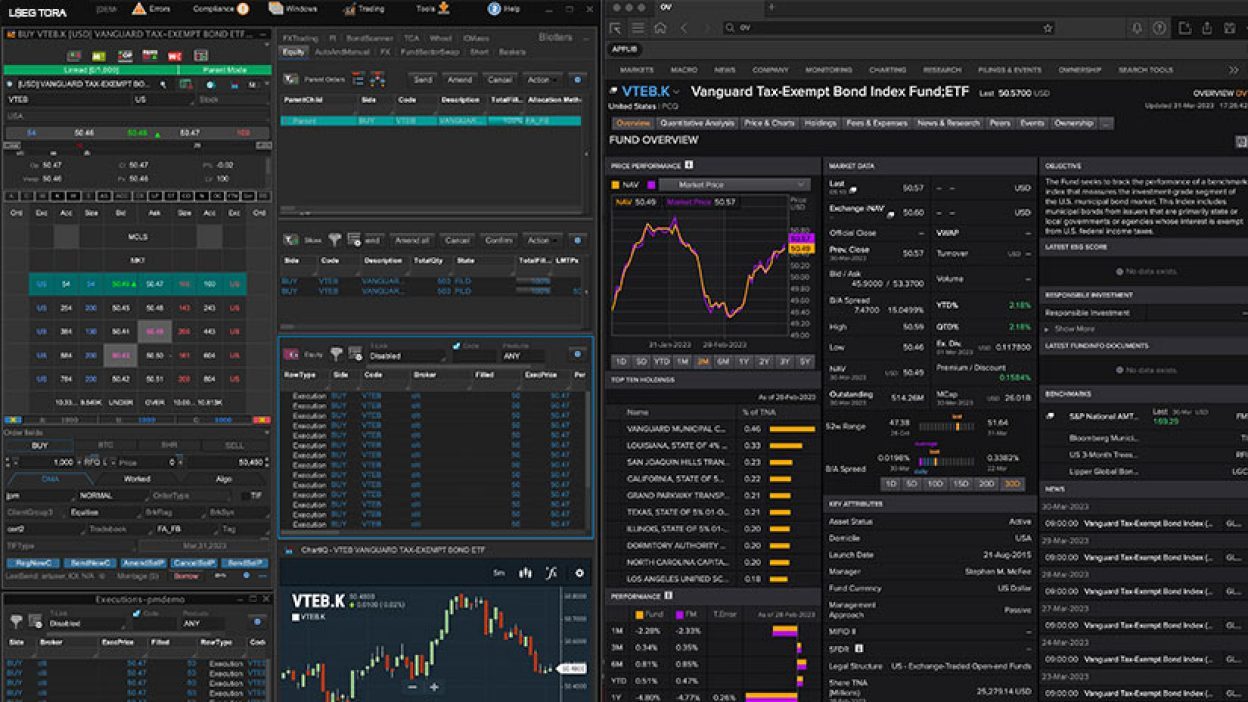

With TORA, users have access to advanced functions for order management, portfolio rebalancing, pre-trade and post-trade TCA, allocations and commission management tools.

This integrated software package already connects with custodians, prime brokerage and trade matching providers across the globe. The functionality is fully auditable, MIFID II-compliant and automatically details in depth order records, price information, best execution reports and analytics.

All products are available individually, or as one integrated and unified platform.

Order & execution management

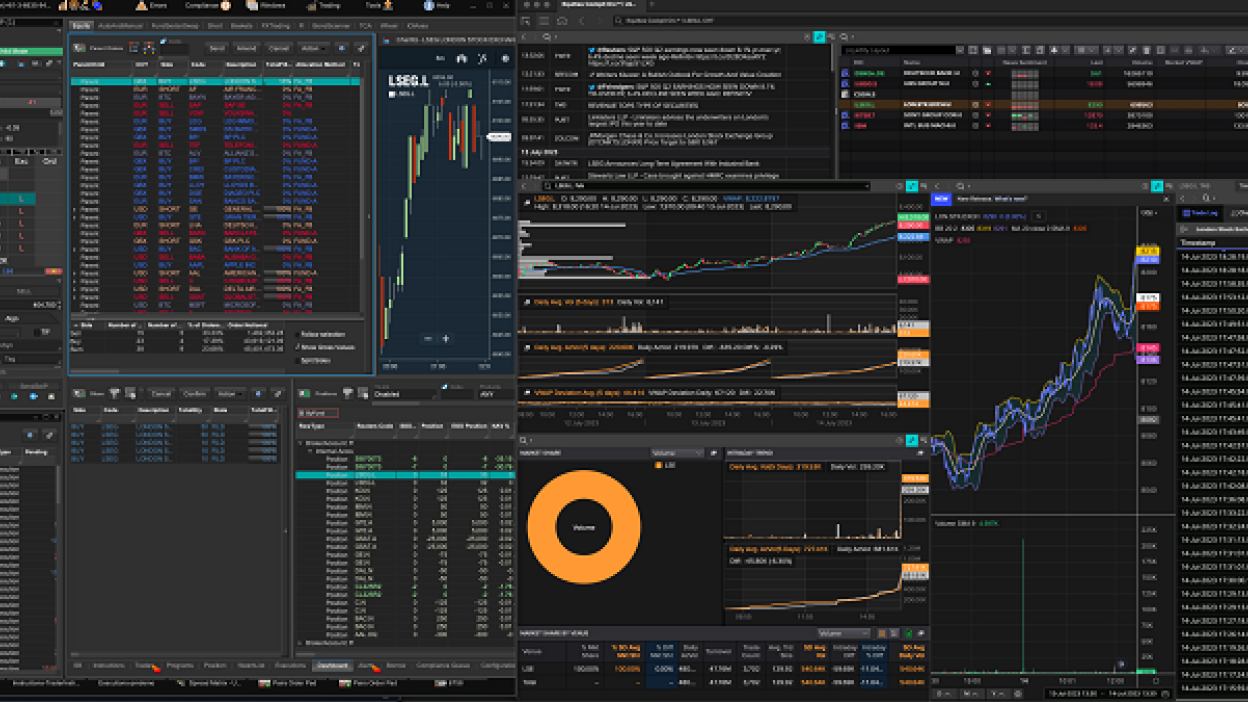

TORA for order and execution management

TORA’s pioneering multi-asset cloud-based OEMS offers state-of-the-art solutions for all your trading needs.

Execution management

Access the very latest multi-asset broker algos and trade across a variety of asset classes such as global equities, FX, derivatives and fixed income.

Features:

- Easy-to-use interface with unmatched flexibility to suit your trading workflows

- Access a broad network of brokers and venues via TORA FIXNet and other major FIX networks

- Access the very latest multi-asset broker algos

- Basket orders, position-based orders, parent/child orders, pairs orders

- On-screen audit trail of all trades and actions made

- Access to best-in-class proprietary pairs trading algo suite and the option to use FX auto-hedging

- Powerful alerts engine for market and order monitoring

- Integrated with ChartIQ and access to various graphical tools to aid visualisation

- Websocket API, FIX API for systematic trading

- AWS cloud-based technology for fast and flexible deployment

Order management

Organise all of your orders, re-balance portfolios, monitor positions and P&L from the same interface as you manage your market executions.

Features:

- Allocations and commission management engine with smart defaults improve data integrity

- Integrations with prime broker and fund admin platforms

- Real time positions and P&L monitoring

- What-if analysis and rebalancing

- Transaction history available directly from the GUI

- Order and venue analysis tools

- More borrow electronic locate integrations than any other platform

- AWS cloud-based technology for fast and flexible deployment

Post trade

Part of our OEMS, a range of post-trade functions and integrations to create a truly Straight Through Process (STP).

Features:

- Advanced commission, cost and fee schedule management

- Two-way integration with leading trade matching providers

- Support for complex rounding and aggregation methodologies per counterparty

- Block formation and allocation

- Auto Trade Pairing and Matching at block and allocation levels

- Cancel / re-book trade framework for seamless revisions and reporting

- European Approved Reporting Mechanism (ARM) integration and other regulatory reporting workflow solutions

Reporting

Our reporting solution gives asset managers the ability to see and report on their trading operations anytime, anywhere.

Features:

- Integrated with analytics and data visualisation platform

- Perform calculations on any data source and create reports with advanced charts

- Access via web or mobile device

- Immediate view into their trading operations

- Real-time results in graphic visualisations that put data at the users’ fingertips

Transaction cost analysis (TCA)

LSEG TORA’s clients benefit from post-trade TCA, pre-trade TCA and broker algo recommendations.

Real-time, actionable analytics - Delivers actionable TCA data to portfolio managers and traders across the order life cycle. Customised, delivered and managed by the same people and technology that run all your software.

You decide what you want to see - Adjust analytics parameters on-the-fly so you get to see the data you care about and that your firm measures performance by. Get it in real-time so traders can take action, like routing to venues with better fill quality.

Leverage TCA data to achieve MiFID II best execution compliance - Use integrated pre-trade and intra-day analytics to drive execution strategy selection, and capture the entire process in a best-execution audit trail.

Features:

- Pre- and post-trade TCA from the same provider for an optimised feedback loop

- Our AI-powered pre-trade TCA is a quantitative optimiser providing traders with real-time broker execution strategy recommendations

- Both available in real time in the traders’ blotters or in the visualisation and reporting tool

- View performance versus a range of standardised benchmarks

- Partitioned and ranked by broker, country, sector, strategy or any required split

- Order and venue analysis

- Analytics available in the reporting web tool and in the OEMS blotters

- Interactive dashboards which offer a range of metrics for intra-day decision making and for detailed longer term analysis

Compliance

Part of our OEMS, utilise advanced rule and limit features to improve compliance without impacting workflow or affecting latency.

Features:

With automated updates, reports and real time reconciliation LSEG TORA eliminates long and manual compliance tasks, by providing everything you need in one system.

- Permissioned users can set up new compliance checks on the fly

- Automation for restricted trading lists

- Flexible work flows with optional approval protocols

- Large library of portfolio and trading based compliance checks

- New rules delivered dynamically without requiring upgrades

- Sub-millisecond latency and high-throughput portfolio and trading compliance engine

Rebalancing

Rebalancing functions are available natively in our OEMS to help asset managers improve workflow efficiencies and reduce operational risk.

Features:

- Portfolio modelling and what-if/scenario analysis

- Rebalance portfolio weights to maintain or adjust characteristics with real-time order generation and pre-trade compliance integration

- Single view for rebalancing multiple portfolios such as separately managed accounts and primary fund portfolios

- Share and repurpose portfolio models between teams

- Manage subscriptions and redemptions

Pairs trading

Our broker neutral pairs algo suite is a must have for arb-focused desks and funds.

Trade simultaneously cross-asset class, cross-market and cross-currency pairs with the option to execute different legs with different brokers.

Features:

- Various execution styles to control aggressiveness of each leg

- Market-driven and rule-based actions to manage unhedged risk

- A variety of strategies including classic spread and ratio, rights arbitrage, merger arbitrage and daily percent return

- Automate floating and hedging legs based upon historical volumes

- Manage volume participation at multiple levels

- Parameters to support unbalanced quantities through auto-adjustment

- Retain control of all legs simultaneously

- Link in-house signals via API

Stock borrow

Reduce your stock borrow process to a single step with our eLocate function within our OEMS.

Features:

- eLocate streamlines, automates and simplifies the short sell process to a single click, reducing any direct trading impact and operational costs

- Integrated with all major broker stock lending desks

Portfolio management

TORA for portfolio management system

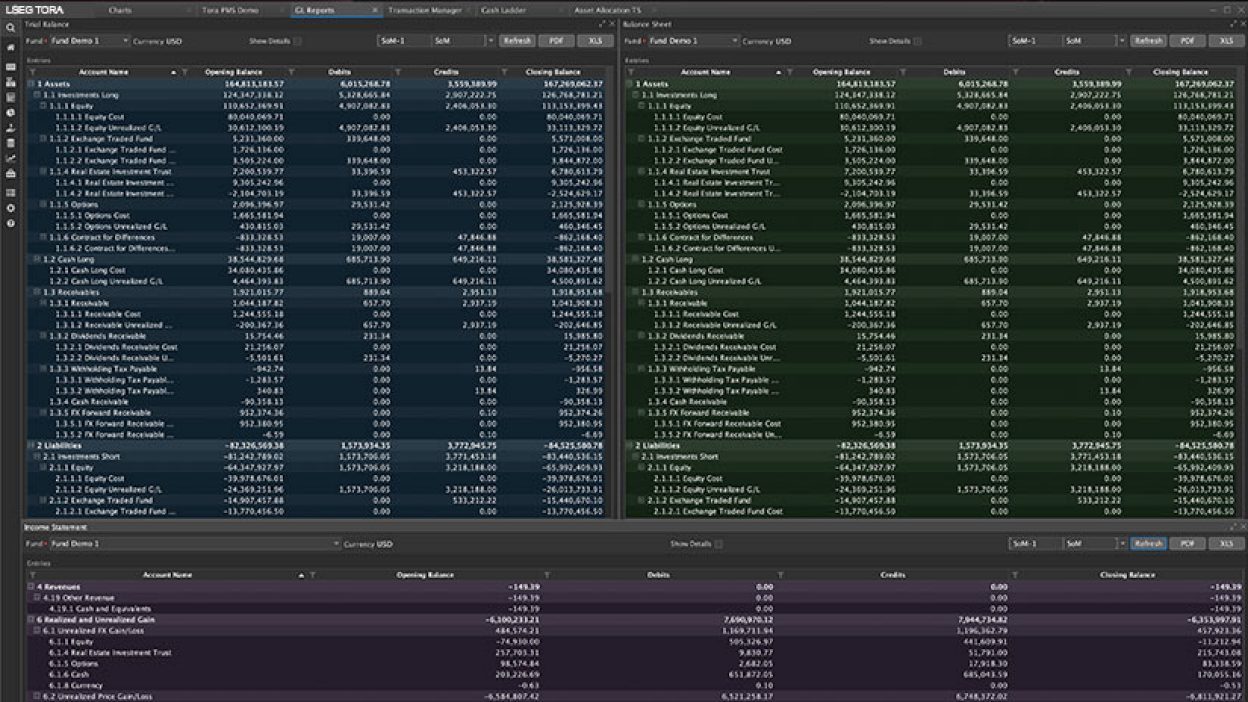

Trade and market data in an advanced general ledger with detailed pricing and performance information, with real-time series and state-of-the art charting dashboards.

TORA PMS features

- Full General Ledger and Shadow Accounting reports (financial statements, cash and NAV reconciliation)

- Real-time and historical P&L over anytime interval or at any point in time on-the-fly

- Time Series support with daily snapshots of P&L, NAV, exposure, fees and other portfolio related indicators, accessible via a flexible user interface, API or directly within Excel

- Create new views on portfolios with up to 500,000 positions in seconds

- Capture trades on any asset class and price using valuation models, or via integrations with third-party providers

- Comprehensive support of equity swap contracts with complex configurable payment schedules and daily accrued interest reflected in P&L

- Unmatched borrow management functionality

- Managed corporate actions and reference data

- Flexible, real-time portfolio and analytics views and powerful API function

- Real-time trade capture builds historical, audited, and reconciled book of records

- Automated trade matching, regulatory reports, and borrow contract management

- Full SWAP contract support, Leading swap contracts tools. Track specific cash flow streams during any stage of the contract. Integrated tracking of P&L indicators and daily accrued interest

PMS Functionality

Our PMS system is utilised by the industry’s leading hedge funds, asset managers, proprietary trading firms and trading desks globally.

Access all your trade data in one place with one single sign on. Our new generation PMS is fully integrated with our OEMS to provide a completely unified user experience for all fund trading requirements.

Tracks your data positions and performance with fully customisable, drag-and-drop views in real time. See all of your positions across multiple portfolios on one screen. Flexible reconciliations covering all counterparties.

Real time General Ledger based financial statements reports: trial balance, balance sheet and income statement reports for any configurable time-frame. Shadow accounting reports for cash and NAV reconciliation.

outsourced trading

TORA for outsourced trading

Our outsourced trading offering has the flexibility to integrate with your existing systems, or we can provide an end-to-end operational solution to cover the entire life-cycle of a trade.

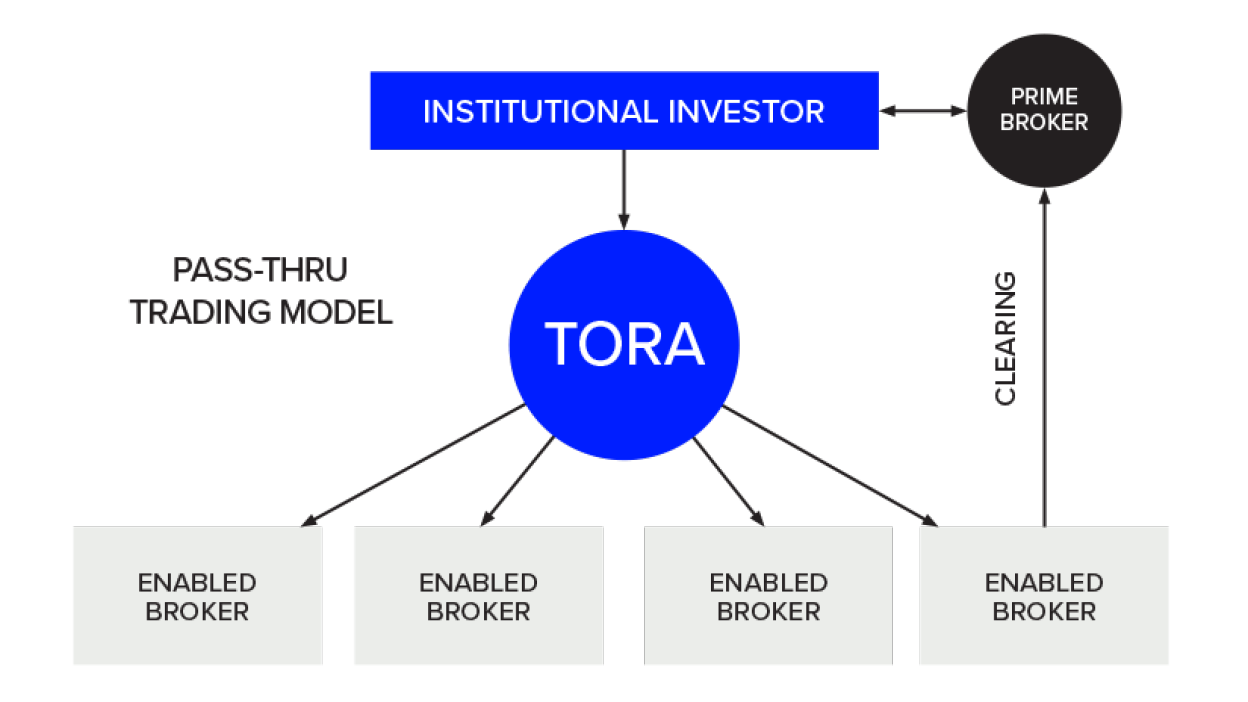

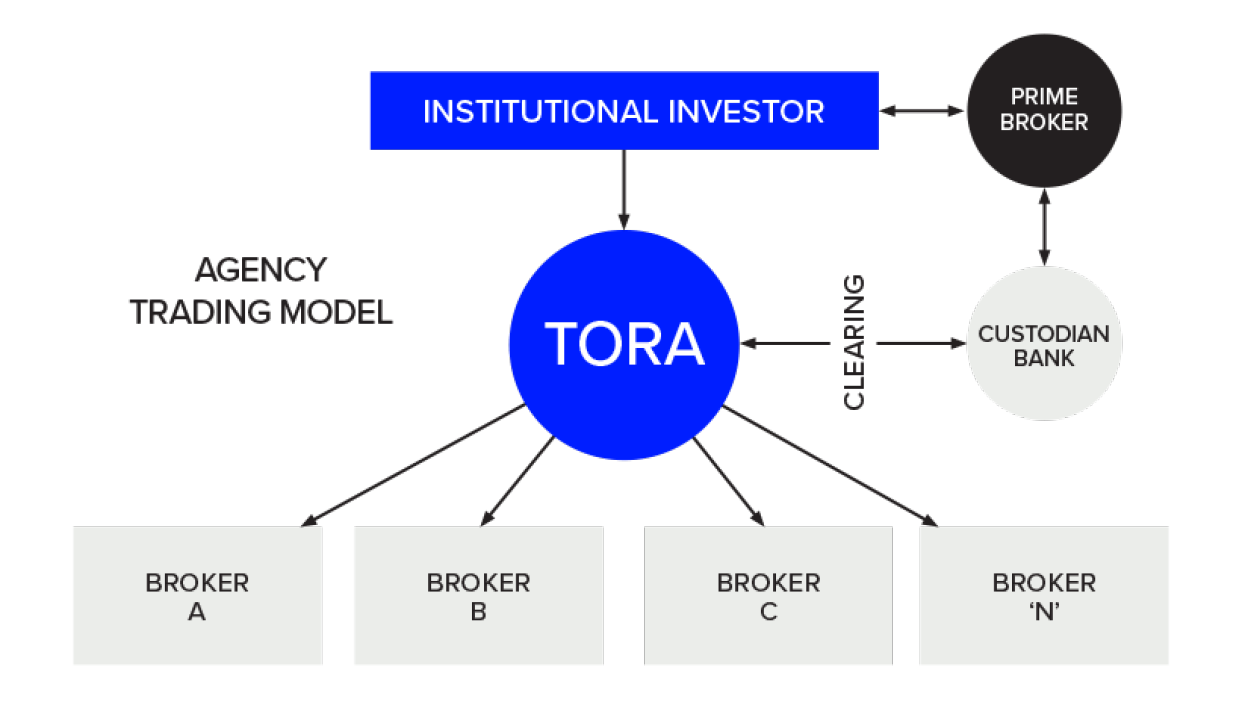

Our models

We keep the primary relationship between client and broker intact. As a broker-agnostic service provider, our objectives are aligned with those of our clients, allowing us to provide unconflicted global execution.

Pass-through trading model

An extension of the internal dealing desk - we transact in the client’s name, with the same workflows and compliance controls as an in-house desk.

Agency trading model

An external dealing desk. We transact in our name on the client's behalf, a conduit process to access a broker panel with commission attribution.

Supported by our quantitative best execution team

Pre- and post-trade transaction cost analysis

QBE works to improve execution methodology utilising an algo ranking system built on a regression model using machine learning. Factors selected are significant and intuitive and real–time data is incorporated so that model recommendations reflect current market conditions.

A consultative approach is taken with our clients to incorporate specific trading styles and objectives.

Workspace

Workspace and TORA

TORA’s order execution management system (OEMS) has a side-by-side functionality with Workspace.

Workspace is the highly customisable workflow solution that gives users access to some of the broadest and deepest coverage of financial data, news, analytics and productivity tools.

Workspace and TORA gives users the ability to generate trade ideas within Workspace and then quickly act upon them by creating a TORA trade ticket from your Workspace menu.

Features:

- Bi-directional communication exists between the two solutions

- TORA users can instantly access Workspace in one seamless GUI

- Access to all the latest financial market data and analytics

- Cutting-edge web technology seamlessly syncs across desktop, web, mobile and tablet

- Work at any time, from anywhere

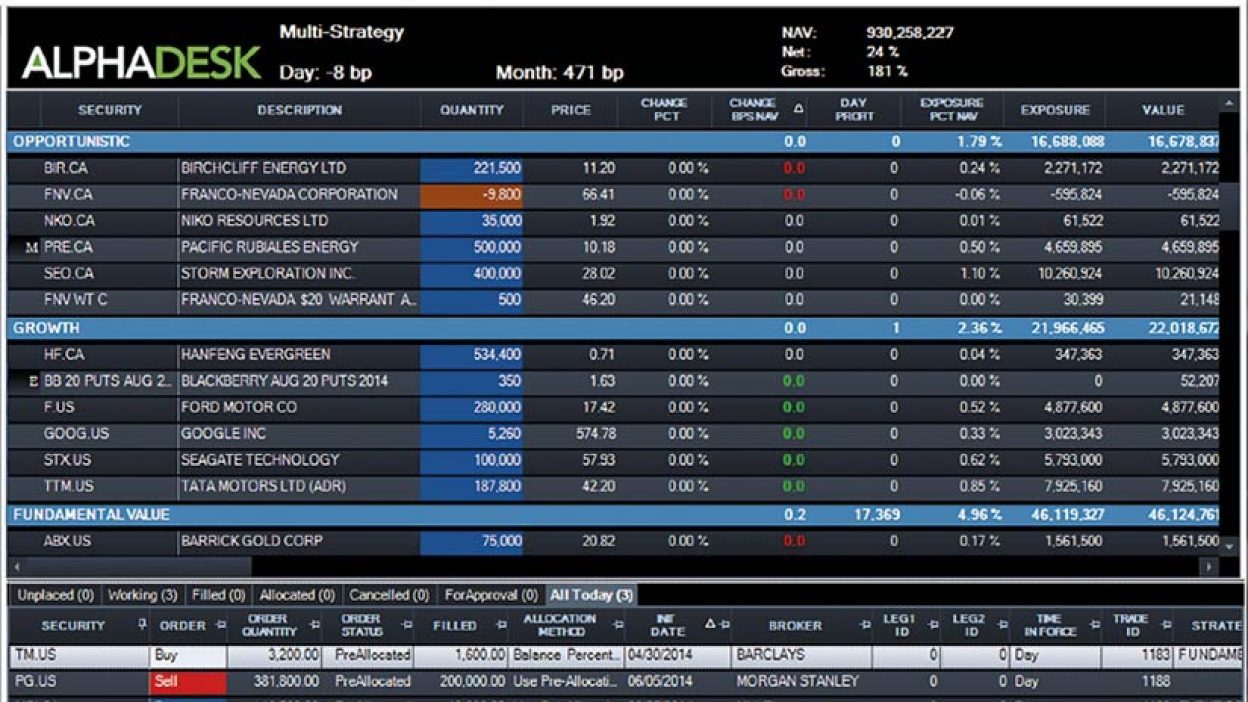

AlphaDesk

AlphaDesk PMS and TORA EMS

TORA’s Execution Management System (EMS) and AlphaDesk (PMS) have now integrated to bring the industry’s best in breed products together in one system.

The front to back solution delivers an open and powerful end-to-end trading solution across equities, fixed income, derivatives and FX.

Traders can manage all your firm’s orders in a single place cloud-based multi-asset class order, execution and portfolio management system with detailed pre-trade data and analytics, post trade, risk management, reporting, TCA, trade automation and compliance functions.

Features:

- Risk management includes Value at Risk, Scenario Analysis, Liquidity Risk and Interest Rate Risk

- Multi-vendor data feeds and multiple electronic trading systems, as well as custodians/prime brokers and fund administrators

- Track P&L exposure in real time with a choice of over 100 fields and flexible groupings

- Easy-to-use interface with unmatched flexibility to suit your trading workflows

- Broad network of brokers and venues via TORA FIXNet and other major FIX networks

- Access the very latest multi-asset broker algos

- Basket orders, position-based orders, parent/child orders, pairs orders

- On-screen audit trail of all trades and actions made

- Access to best-in-class proprietary pairs trading algo suite and the option to use FX auto-hedging

- Powerful alerts engine for market and order monitoring

- Detailed charts and analytics

- Websocket API, FIX API for systematic trading

- Pre- & post-trade compliance and rebalancing, subscriptions/redemptions

- Real-time and historical detailed reporting with full shadow NAV, automation of trade reports and reconciliations

- Full project management of all new client implementations including ongoing white-glove support teams

Asset classes

LSEG TORA is a true multi-asset front- to back-office trading technology provider.

It provides access to 500 over the latest multi-asset broker algos and allows you to trade across a variety of asset classes, including global equities, FX, derivatives and fixed income in one unified platform.

Derivatives

Our clients are able to trade futures and options.

LSEG TORA’s unified platform offers access to intuitive tools to search for, and quickly execute futures and options contracts.

Features:

- Full STP

- Rebalancing and bucketing

- Suite of broker algos

- Proprietary TORA pairs trading

- State of the art real time reporting

- Automated order routing

- Intuitive and customisable UI

- Compliance management

- Real time positions

- P&L monitoring

- Connectivity to various trading venues

- Order execution using different protocols

- Historical analysis of trade execution quality

- Fixed income futures and options

- Global coverage of multi-asset futures and options

- Connectivity to global brokers and their algos

- Access the very latest multi-asset broker algos

- Single click trading

- Basket orders, position-based orders, parent/child orders and pairs orders

- Allocations and commissions management

- Portfolio modelling

- Powerful alerts engine for market and order monitoring

- Low latency and liquidity rich

- Post-trade allocations

Equities

LSEG TORA offers market leading OEMS and PMS trading systems for equities.

The systems can be utilised as one single system for all OMS, EMS & PMS requirements or as individual best in breed platforms. Equity traders will have access to the latest TCA & AI for best execution, stock borrowing, rebalancing and pairs trading within the OEMS. The equities PMS also offers a new generation of general ledges, charting capabilities and detailed time series.

Features:

- Full STP

- Detailed pre trade and post trade TCA

- Rebalancing and bucketing

- Stock borrow

- Suite of broker algos

- Proprietary TORA pairs trading

- State of the art reporting

- Automated order routing

- Intuitive and customisable UI

- Compliance management

- Real time positions

- P&L monitoring

- Connectivity to various trading venues

- Order execution using different protocols

- IOI analysis

- Historical analysis of trade execution quality

- Connectivity to global brokers and their algos

- Access the very latest multi-asset broker algos

- Single-click trading

- Basket orders, position-based orders, parent/child orders and pairs orders

- Real-time reports

- Allocations and commissions management

- Portfolio modelling

- Rebalancing and baskets

- Powerful alerts engine for market and order monitoring

- Low latency and liquidity rich

- Post-trade allocations

Fixed income

Use the LSEG TORA OEMS to gain deeper access to secondary market liquidity and to efficiently execute and manage cash bonds in addition to bond and interest rate futures, options and ETFs.

Our OEMS offers support for trading in government, sovereign, supranational, agency, investment grade corporate bonds, high yield, emerging markets, covered bonds and municipal bonds.

TORA is a multi-asset front to back office trading technology provider. You can trade bonds electronically alongside equities, futures, options and FX, in one unified platform.

Features:

- Connectivity to major bond platforms including Tradeweb, MarketAxess, Bloomberg, Trumid, MTS BondsPro and Liquidnet

- Send RFQs from TORA GUI to platforms

- Trade on ATSs from TORA GUI

- Access real time pricing data

- Alerts based on axe and inventory information

- Analyse broker and venue success rates

- Search for comparable bonds

- Book manual and voice orders

- Create automated trading rules

- Intuitive and customisable UI

- Real time positions

- P&L monitoring

- Real time reports

- Allocations and commissions management

- Real time axe and Inventory data: BBG runs, Neptune and Bondcliq

FX

LSEG TORA’s partnership with industry-leading FX market providers delivers access to a multi-asset trading platform offering deep levels of liquidity and a dedicated liquidity management team.

The connection across all venues delivers global multi-asset trading through a single interface, enabling traders to receive liquidity and trade via a single, unified platform.

Features:

- Access an advanced FX product suite offering FX spot, FX forwards, FX swaps & NDFs, all available via RFQ and stream-based quotes and order routing

- True multi-asset system across equities,

options, futures and CBs

- TORA FX offers clients deep pools of liquidity

and has relationships with over 200+ FX liquidity providers

- A highly intuitive &

customisable UI, we can accommodate and meet the needs of individual traders by

offering both manual and API execution capabilities

- Make best execution decisions in real time with access to multi-sourced custom FX liquidity in both disclosed and anonymous pools

- Leading range of proprietary LSEG TORA FX algos

- Access the very latest FX algos from leading liquidity providers

- Pre- and post-trade allocations and best execution analytics

- Powerful low latency liquidity rich environment

- Access a leading primary FX market via a central limit order book where users can post passive orders and earn spread

- Bulk order based RFQ with all in price display across all asset classes including swaps

- FX TCA including cost saving analytics at order level and across specialised bucketing criteria

Digital assets

LSEG TORA’s Digital Assets provides a fully developed OEMS, PMS and RMS in a single interface into all major crypto exchanges and OTC providers, a complete suite of sophisticated crypto trading algorithms, real-time and historical P&L, exposure tracking and professional customer service.

Pioneering institutional crypto trading platform offers unrivalled functionality spanning across:

OEMS

Our fully integrated Order and Execution Management System (OEMS) delivers one platform that connects to all major crypto exchanges, delivers detailed customisable market data, latest crypto algos with smart order routing and parent and child order slicing.

Our digital asset trading platform delivers leading crypto trading technology that traditional institutional investors are accustomed to.

PMS

Full general ledger and shadow accounting, with real-time and historical P&L over any time interval. Our clients can customise views, dashboards and access real-time monitoring of positions across exchanges and wallets – anywhere, anytime.

Algorithms

Complete suite of institutional grade trading algos including VWAP, TWAP, Implementation Shortfall and Volume In-line.

Our digital assets can also integrate algos with distributed exchanges and OTC desks, which can help drive liquidity to DEX’s. Clients can use a comprehensive post trade TCA tool with detailed reporting capabilities to analyse algo performance/exchange execution quality.

Compliance

Clients can set up compliance checks, create automated limits and restricted trading lists with direct compliance manager approval. Users can also see a full audit trail for every order that can be accessed anytime.

Risk Management

Real time and historical risk monitoring. Real time valuations with accurate reconciliations ensuring transactions have been correctly executed.

Pairs Traders

Our market-leading price-spread and price-ratio pairs algorithms enable you to trade pairs using coins on any of the 35 exchanges our digital assets are currently connected to, with coins on the same or different exchanges.

Our Pairs Trader also enables clients to use statistical arbitrage or relative value crypto trading strategies to take advantage of currently inefficient crypto markets.

Features:

- Full General Ledger and Shadow Accounting reports (Financial Statements, Cash and NAV Reconciliation)

- Real-time and historical P&L over any time interval or at any point in time on-the-fly

- Time Series support with daily snapshots of P&L, NAV, exposure, fees and other portfolio related indicators, accessible via a flexible user interface, API or directly within Excel

TORA Services Disclaimer

Tora Trading Services, LLC is a broker dealer registered with the U.S. Securities Exchange Commission ("SEC”), a member of the Financial Industry Regulatory Authority (“FINRA”), and National Futures Association (“NFA”). Tora Trading Services Limited in Hong Kong is registered with the Hong Kong Securities and Futures Commission (“SFC”).

Tora Trading Services, LLC, Tora Trading Services Limited and their affiliates are herein identified as TORA (“TORA”). TORA® is a registered trademark in the United States and other countries throughout the world.

This disclaimer (“Disclaimer”) applies to all TORA-related World Wide Web pages located within tora.com and toratradingservices.com and www.lseg.com/tora, including any content offered on or through the TORA websites. Any use of the TORA websites constitutes acceptance of and agreement with this Disclaimer. This Disclaimer applies to the TORA websites in addition to the Terms of Use.

The information provided on and through the TORA websites is intended only for institutional accounts as defined by FINRA (or institutional professional accounts as defined by SFC) and it is not intended for retail investors/persons. TORA services are not available in all jurisdictions.

Tora Trading Services, LLC Regulatory Notices

Business Continuity Planning Summary

In accordance with the SEC and FINRA regulations, Tora Trading Services, LLC (“Tora”) is committed to ensuring its continued ability to serve its clients and to protect the people and assets of Tora. Our Business Continuity Program (“BCP”) has been developed to provide reasonable assurance that we can continue to do business with little or no disruption if an unplanned interruption occurs at our critical facilities. We have established a process designed to ensure that we are prepared should a business disruption occur. This process addresses business disruptions of varying scope, including, but not limited to, medium and large-scale events involving the disruption of business, technology systems, and displaced personnel. Our plan includes leveraging our resources and infrastructure through relocating impacted business units.

Although we have taken significant steps to develop and implement a sound BCP and business recovery plan, we cannot guarantee that systems will always be available or recoverable after a disaster or significant business disruption. We believe however that our planning for such events is robust and consistent with many of the best practices established within the industry. Any material changes to the above information will be available on our website or upon request.

Customer Identification Program

Important Information You Need to Know about Opening a New Account:

To help fight the funding of terrorism and money laundering activities, federal law requires us to obtain, verify and record information that identifies each customer who opens an account or otherwise contracts with Tora Trading Services, LLC (“Tora”). Accordingly, when you establish an account or contract with Tora, we will ask you for identifying information that will satisfy our Know Your Customer requirements, processes, and procedures.

Privacy

Please review the following below in addition to the Privacy Statement.

Electronic Communications

When you visit tora.com, toratradingservices.com, or lseg.com/tora or send e-mails to us, you are communicating with us electronically. You consent to receive communications from us electronically. We will communicate with you by e-mail or by posting notices on this site. You agree that all agreements, notices, disclosures, and other communications that we provide to you electronically satisfy any legal requirement that such communications be in writing.

Additional Information

If you have any questions regarding these notifications or require further information, please do not hesitate to contact your account representative.